The Future of Equity Investing — Why Do Investors Choose It?

Equity investing in hotel real estate means that each investor owns a share of the property (for example, a room or other premises) and receives income proportional to the invested funds.

Expert column by the founder of the development and investment company Arha Group – Igor Ilchyshen and the founder of the Ribas Hotels Group – Artura Lupashko, published in ThePage.

Equity investing in hotel real estate means that each investor owns a share of the property (for example, a room or other premises) and receives income proportional to the invested funds.

There are several models of such investment – in particular, equity participation (investors invest funds at the construction stage of the facility), fractional ownership (investors buy a finished facility), cooperative model (a group of people pool funds, and the facility is registered under one legal owner) and condo-hotels (each investor owns a separate room, but the hotel is managed centrally by a management company).

Advantages of equity investment

Firstly, it is a moderate entry threshold. The initial contribution can be from 5-10 thousand dollars. It is important that there is no deferral: a person invests, for example, 5 thousand dollars and immediately becomes a co-owner of real estate. While when buying an entire property it takes time to pay off the deferral, a larger amount and a lot of legal work are required (property rights, extract from real estate, etc.).

Thus, equity investing is available to a wider range of investors, adding democracy to the investor portrait we are used to.

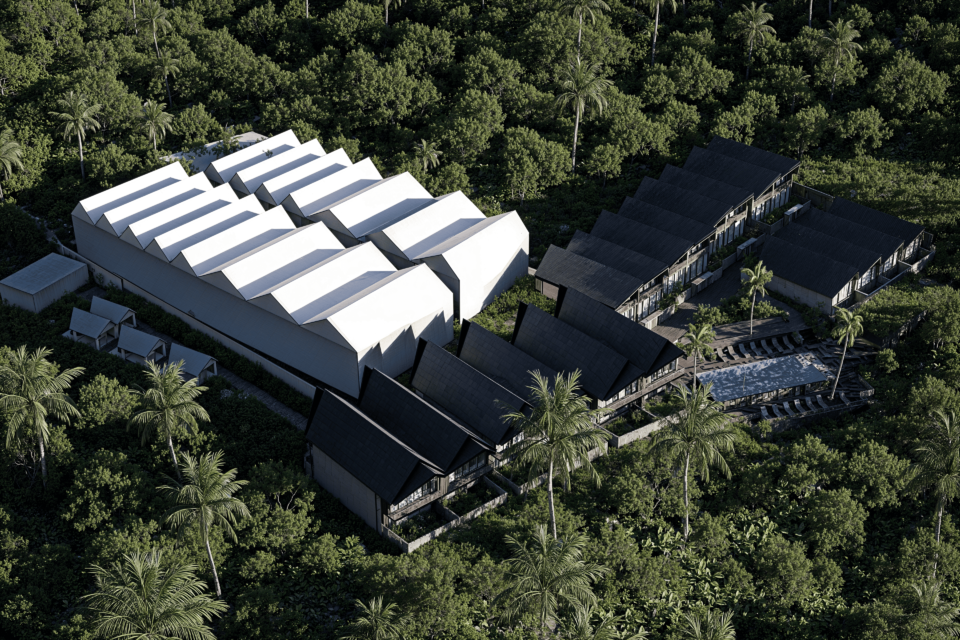

Secondly, equity investing allows you to participate not only in the ownership of apartments or cottages, but also in larger facilities, such as spa areas, restaurants, supermarkets, shopping centers, etc. That is, you can invest in various types of commercial premises.

This leads to increased interest in the tourism industry, and also not only stimulates domestic investments, but also helps them remain in the domestic market.

Thirdly, the advantage is that the cooperative, i.e. the associated company that serves shareholders, acts as a tax agent. This is convenient for investors, as it relieves investors of the tax burden.

Potential risks of equity investing

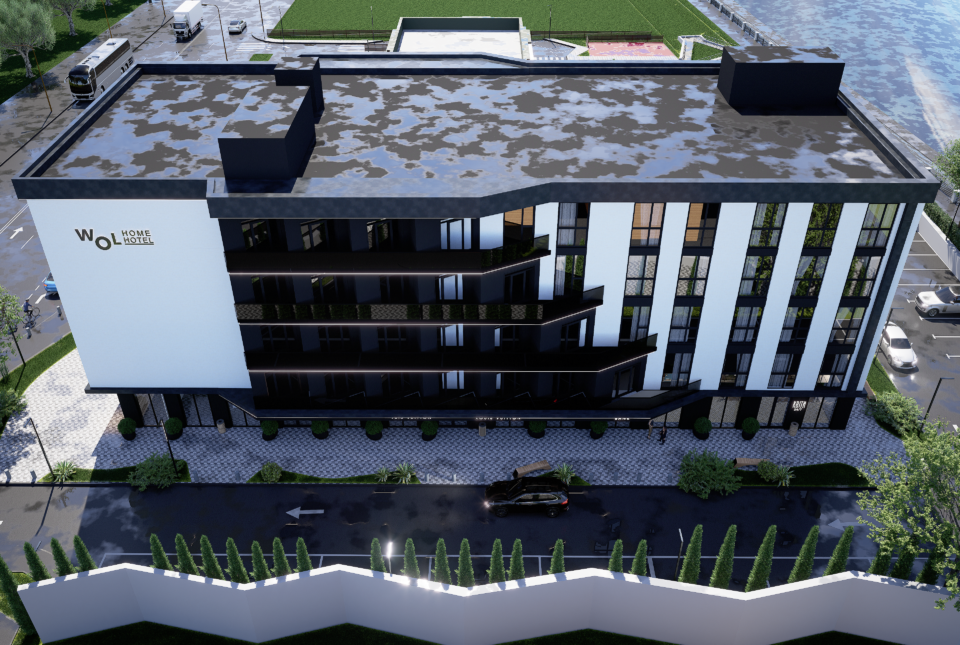

The potential risks of equity investing are absolutely identical to the risks of investing in whole real estate. The first and biggest risk is the incomplete construction of the facility. The second significant risk is the low occupancy of the hotel or the discrepancy of the real facility with what was presented in the visualizations (renders), or the discrepancy of the concept.

To minimize these risks, it is important to check the reputation of the developer (and it is better to cooperate with reliable market participants with a good reputation, if possible), analyze the documents and involve legal consultants at the stage of concluding the contract.

Obtaining profit and distribution between investors

The profit is distributed in proportion to the share invested by each investor. For example, if the total cost of the apartment is $ 100 thousand, then the investor who purchased a share for $ 20 thousand will receive a greater profit than the one who purchased a share for $ 10 thousand. This is logical, because it all depends on the amount of investment.

The investor’s share, if desired, is subject to sale or inheritance, usually with the right of first refusal by other participants.

Usually, a minimum entry threshold is set, for example, $10,000. The larger the investment amount, the greater the profit the investor receives. However, if all participants purchase the same shares, then the profit is distributed evenly between all owners of the associated company.

It is also worth adding that each investor registers his share as separate property or as part of joint ownership, and the obligations are regulated by agreements on the maintenance of the facility and the division of costs.

Operational features of working with equity investors

The operational features are that different legal conditions apply here, in particular regarding the use of real estate. Unlike whole real estate, where the owner can live in his own room or cottage (the period of residence is in accordance with the terms of the contract), such residence is impossible with equity investment. On the other hand, the investment process is much simpler from a legal point of view: there is no need to involve a notary to register the ownership title or certify the receipt of funds.

The procedure is much easier, which is why it is so popular among investors.

Understanding at any given moment what stage the construction is at, concluding clear and transparent contracts, flexibility of the payment system, quality control of construction work, as well as the ability to invest a small amount without significant organizational efforts contribute to investor confidence and successful implementation of projects.

An additional advantage is that all documents are signed remotely through services such as “Diya” or “Vchazno”.