Poland is one of the leaders in the growth of the European hotel market

European tourism: a new phase of revival

The European tourism sector is showing steady growth.

In 2024, the following figures were recorded:

- 747 billion tourists in Europe;

- €1.8 trillion contribution to GDP;

- 26 million people employed in the tourism and hospitality sector;

- projected growth of the hotel market to $117.8 billion in 2025.

Poland: focus on stability and growth

Poland has become one of the leaders of this growth.

This is stated in the study ‘The European Hotel Market: A Detailed Overview of Poland’ prepared by Ribas Hotels Group and Ribas Invest.

The country is demonstrating growth that exceeds the European average:

- $45.26 billion contribution of tourism to GDP (4.4% of the economy) — higher than the pre-pandemic maximum

- $12.28 billion — Poles’ spending on domestic travel

- 901,000 jobs — more than before the pandemic

- By 2035, Poland’s tourism sector could generate $60.6 billion in GDP and create another 86,000 new jobs. The economy is growing steadily at around 3.4% in 2025–2026, and the volume of investment deals in the hotel sector has increased by 130% over the year — one of the highest rates in Europe.

What should Ukrainian developers focus on?

What risks await investors in 2025–2027 — from seasonality to rising capital costs?

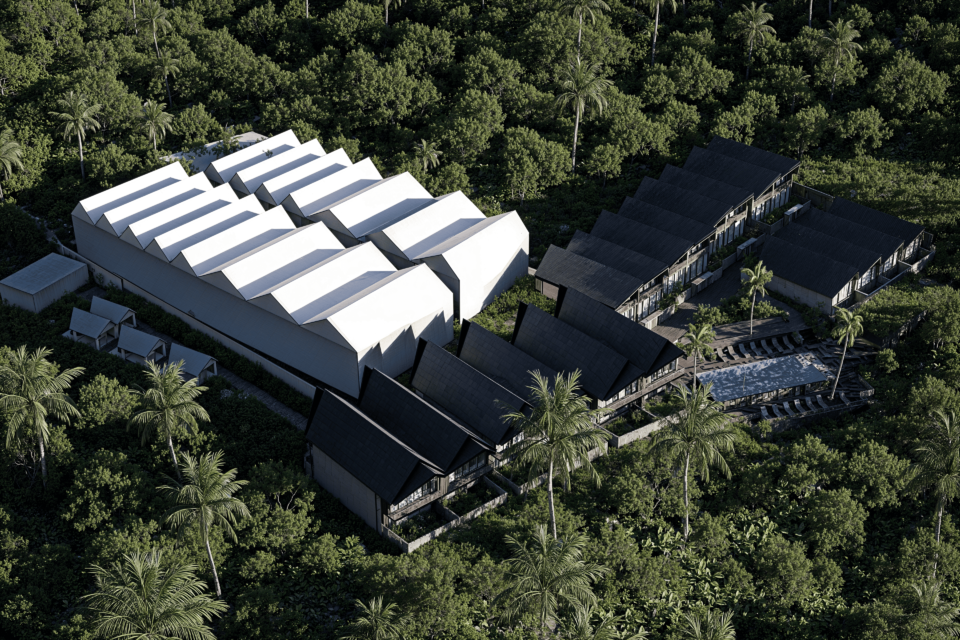

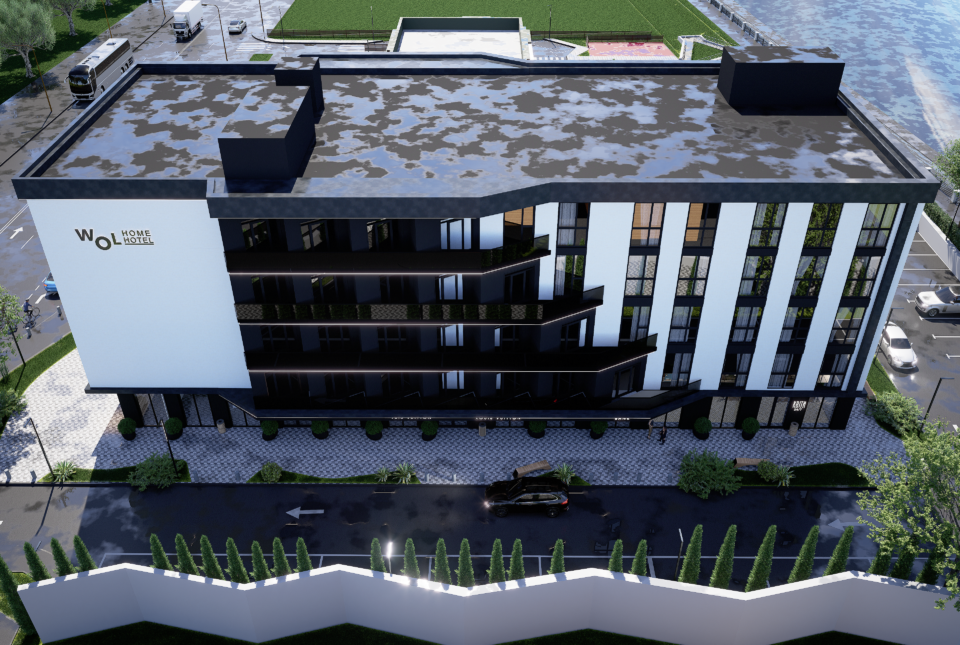

Which formats provide the highest ROI — apart-hotels, franchise chains or resort complexes?

Which regions demonstrate the best return on investment and stable occupancy rates?

How is the structure of demand changing between the leisure, business and wellness segments?

What are the barriers to entry into the Polish market for foreign investors and how can they be reduced?

What tax and legal considerations should non-residents take into account when purchasing hotel real estate?

Which management models work more effectively — lease, franchise, management contract or hybrid?

The answers to these questions can be found in a comprehensive study by Ribas Invest, which contains detailed analytics, figures, case studies and market forecasts until 2030.

Read the full version on our Telegram channel:https://t.me/income_property_bot