2024 Ukrainian Hotel Market Overview Study Results

Ribas Hotels Group is continuing a series of studies on the Ukrainian hotel market. This time the company has presented “2024 Ukrainian Hotel Market Overview”.

According to the study, Ukraine is continuing to actively rebuild its tourism industry despite the challenges posed by the war, the COVID-19 pandemic, the annexation of Crimea, and the ongoing occupation of part of the country’s territory. So since 2013, the total number of collective accommodation facilities has been decreasing by about 175 facilities a year. The biggest decline has been in health centers, health and recreation resorts, boarding houses with medical care, balneological and mud-bath resorts, tourist centers and camps, camping sites, recreation centers, and vacation resorts.

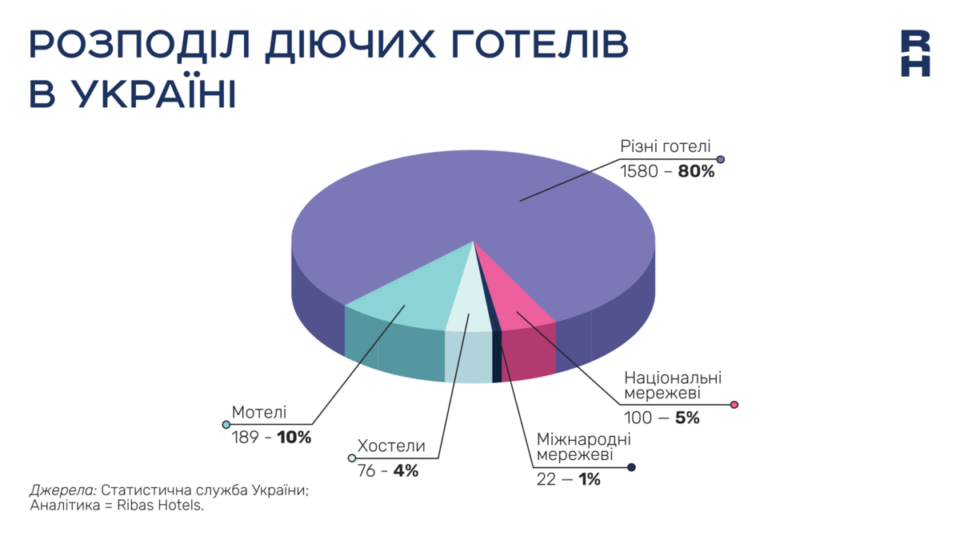

However, the number of hotels (+9.1%), motels (+10.7%), and hostels (+28.7%) is growing in real time, despite the negative effects caused by the war; 12 hotels have been destroyed or damaged since the outbreak of the war in Ukraine.

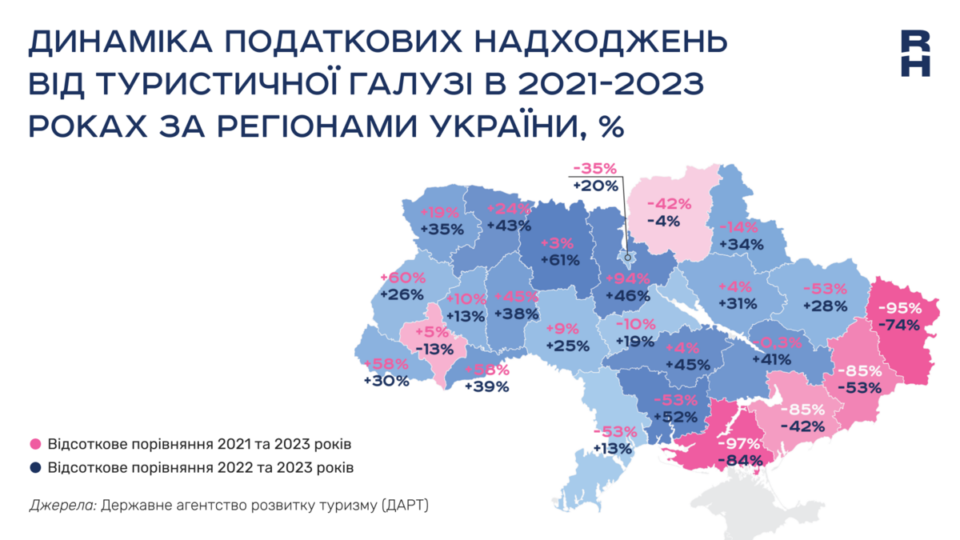

Ukraine’s hospitality market has demonstrated resilience even in the toughest times. The country’s tourism industry is recovering driven by domestic tourism, temporarily displaced persons and returnees. So according to the State Agency for Tourism Development, 13 Ukrainian regions (Vinnytsia, Volyn, Zhytomyr, Zakarpattia, Ivano-Frankivsk, Kyiv, Kirovohrad, Lviv, Poltava, Rivne, Ternopil, Khmelnytskyi, Chernivtsi regions) generated more tax revenues from tourism in 2023 than in the pre-war year of 2021.

There has also been a significant growth in the segment of hotels managed by national operators such as Ribas Hotels and Optima Hotels, particularly in Bukovel, Lviv, Vinnytsia, Khmelnytskyi and other regions. Optima Hotels (64 hotels), Ribas Hotels (21 hotels), and Premier Hotels and Resorts (11 hotels) are the leaders in terms of the number of hotels in Ukraine.

The number of international hotels is also steadily growing (Park Inn by Radisson Troitska opened in May 2017, Mercure Kyiv Congress in November 2017, Aloft/SkyLoft in March 2018, and Best Western Plus Market Square Lviv in August 2022). Among foreign chains, Accor (9 hotels) and Radisson (5 hotels) have the largest number of hotels.

The war has forced some Ukrainian hotel chains to expand their operations to international markets. For example, Reikartz is developing in Kazakhstan, Uzbekistan, and Georgia, Premier Hotels is opening properties in Hungary, and Ribas Hotels is developing projects in Indonesia (Bali), Poland, and Moldova.

According to the State Agency for Tourism Development, Ukraine’s tourism industry is continuing to recover, driven in part by an increase in domestic tourism and the gradual return of foreign visitors, including government delegations, international companies, and volunteer organizations. Q1 2024 showed a 19% increase in the number of taxpayers over the year. The national budget revenues are still growing.

In mid-2024, the occupancy rate of the room inventory in Ukraine ranged from 34 to 38%, and in some demanded regions (Lviv, Ivano-Frankivsk, Zakarpattia regions) it exceeded 60-70%, which is comparable to the rates of the world’s major tourism centers.

Ukraine is also taking significant steps on the international stage to promote the country as a prominent tourist destination. For the first time ever, our country chaired the UN European Commission on Tourism, which opens up new opportunities for sharing experience, improving services, attracting investment, and creating joint projects to rebuild war-damaged tourism infrastructure.

So despite ongoing challenges, Ukraine’s tourism industry demonstrates remarkable resilience and prospects for further growth. The country expects to implement at least 45 new projects of hotel and apartment complexes with a total of 6,670 rooms along with 108 hotel-type cottage towns with a total of 3,097 houses in the period from 2024 to 2026. This is one of the fastest growing segments of the market because Ukrainians are increasingly investing in income property as an effective way to boost their savings. Ukraine is further gaining ground in the global tourism market, laying a solid foundation for the industry’s post-war revival.

“The hospitality sector in Ukraine is demonstrating tremendous potential even in the most challenging times,” зауважив Artur Lupashko, the founder of Ribas Hotels Group. “Investing in this sector right now is strategically vital as this lays the foundation for further growth and development of the hospitality industry after the war. We are convinced that Ukraine has every chance to become one of the leading tourist destinations in Europe.”

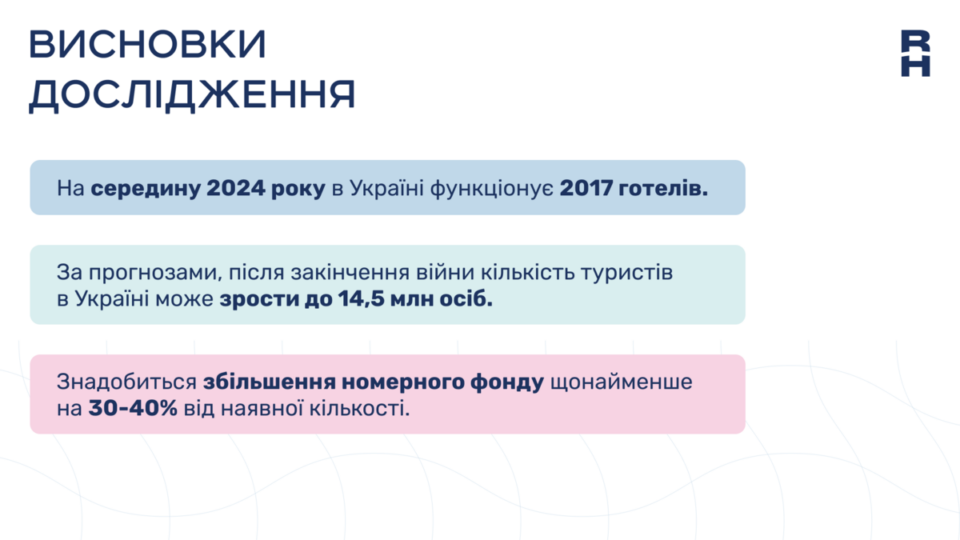

The study shows that the Ukrainian hotel market, despite the challenges brought about by the war and the pandemic, is highly resilient and has prospects for further growth. As of mid-2024, there are 2,017 hotels operating in Ukraine but the total room supply is still too low to meet the expected demand.

According to estimates, the number of tourists to Ukraine is expected to reach 14.5 million after the end of the war. Given these figures, the number of operating hotels and rooms on the market is far behind the upcoming demand. To meet the needs of the growing tourist traffic, the number of rooms should be increased. According to preliminary estimates, the current level of new hotel construction is too low.

If the room supply does not meet the demand, there will be a need to increase the room stock by at least 30-40% of the existing inventory.

Read more about the market in our study entitled “2024 Ukrainian Hotel Market Overview”. You can request it through the chatbot at: @income_property_bot.

The data used for analysis in the study were sourced from the State Statistics Service of Ukraine, the State Agency for Tourism Development, the State Border Guard Service of Ukraine, Tourist Barometer of Ukraine, the Main Department of Statistics in Kyiv, the Main Department of Statistics in Odesa region, the Main Department of Statistics in Kharkiv region, the Main Department of Statistics in Dnipropetrovsk region, Lviv City Council, Lviv Regional State Administration, the Ministry of Culture of Ukraine, the State Register of Immovable Monuments of Ukraine, the service portal for tourists, the hotel aggregator and the statistics aggregator.