What is the situation of the hotel business during the war

Author: Artur Lupashko, founder of the Ribas Hotels chain

How has the market situation changed since February and what awaits the hotel business in the near future?

Before the great war with Russia, the Ukrainian hotel real estate market grew by at least 10-15% every year. New airlines entered the country, infrastructure was significantly improved in the regions, roads were built. All this encouraged domestic and inbound tourism to develop rapidly and at the same time motivated investors to invest in hotel construction.

Before and After: How the War Affected Hotel Real Estate

In 2021, more than 200,000 tourists from the Arabian Peninsula came to the entire western region of Ukraine and, in particular, to Bukovel. For them, our country has become an alternative to alpine resorts – Austria, Switzerland, Italy. Nine out of ten vacationers interviewed by us claimed that they plan to return to Ukraine again.

In the south, there was an increase in travelers from Israel, Turkey and the Balkans. Every year, the number of foreigners increased by 20-30%. The development of tourism raised the average check for accommodation services by an average of 12-15% and made the hotel business increasingly attractive to investors.

Compared to any other type of real estate, such as the construction or purchase of business centers or warehouses, the yield per square meter of hotel properties has always been at least 5-10% higher. Over the last decade, the value of the hotel business has increased by 110%. In Bukovel, this figure reaches 150-180%, i.e. the price of real estate has actually tripled. In other regions – Kyiv, Odesa, Lviv – doubled. Those who built hotels in the early 2000s have already paid for themselves operationally and even doubled the capitalization of their facilities. Today, the situation on the market is unstable, so we can only follow trends and make predictions.

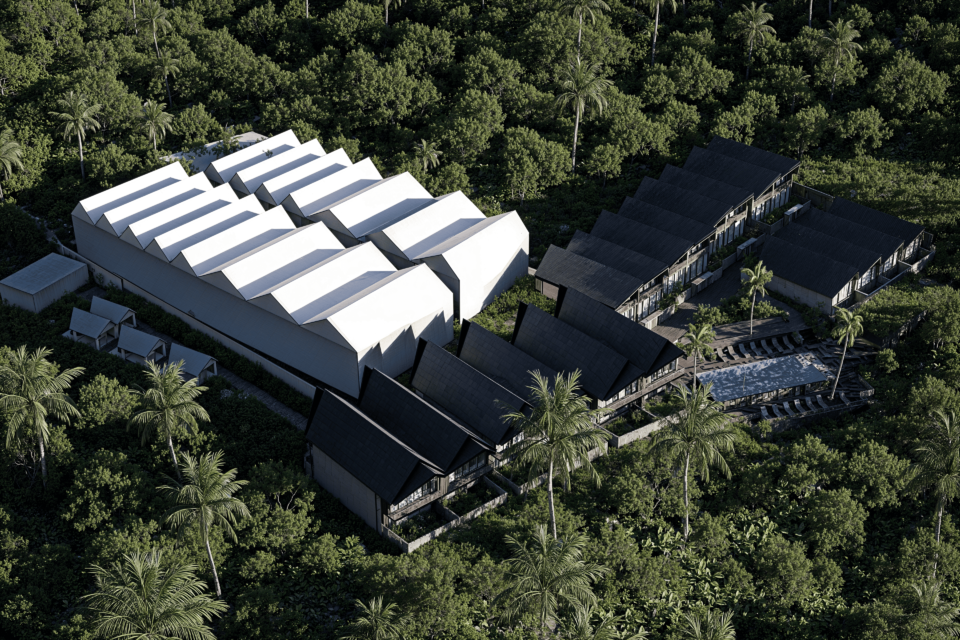

In the west of Ukraine, real estate sales, in particular, in the Berghouse, Skogur Home & Resort, Black & White Villas projects started at $2,500/m². This is 5-10% higher than could be expected last year. Prices are also rising in Ribas Invest projects. So, the first cottages of Ribas Villas were sold for $2,200/m², and the last properties – for $2,750/m². The cost of the European level hotel complex AMA Family Resort started with a price tag of $2,500/m², and should end at $3,500/m².

If we talk about the east and the south, unfortunately, there is still neither demand nor supply, so it is impossible to determine what the market price will be. In general, the Ukrainian hotel market currently operates at a maximum of 2-3% in monetary terms. In the south, this indicator is 3-5% of the planned, in Kyiv and the region – 10-15%, in the east, due to hostilities, business has completely stopped.

Hotels will remain the most interesting objects for investors

During the war, the demand for business centers and shopping facilities decreased significantly. Many companies have moved to another region or closed, so the offices are now empty. If we talk about warehouse real estate, according to the Colliers company, it was in this segment that the greatest activity of investors was observed.

Over the past 5 years, more than 10 investment deals have been concluded on the market. The yield was low – up to 5%, but today the situation has changed due to significant destruction and constant shelling from Russia.

Rental rates continue to rise, at the end their level reached a 9-year high of $6/m² without VAT (A class). We can assume that there will be a temporary demand for such real estate, but in 2-3 years it will close due to a large number of offers.

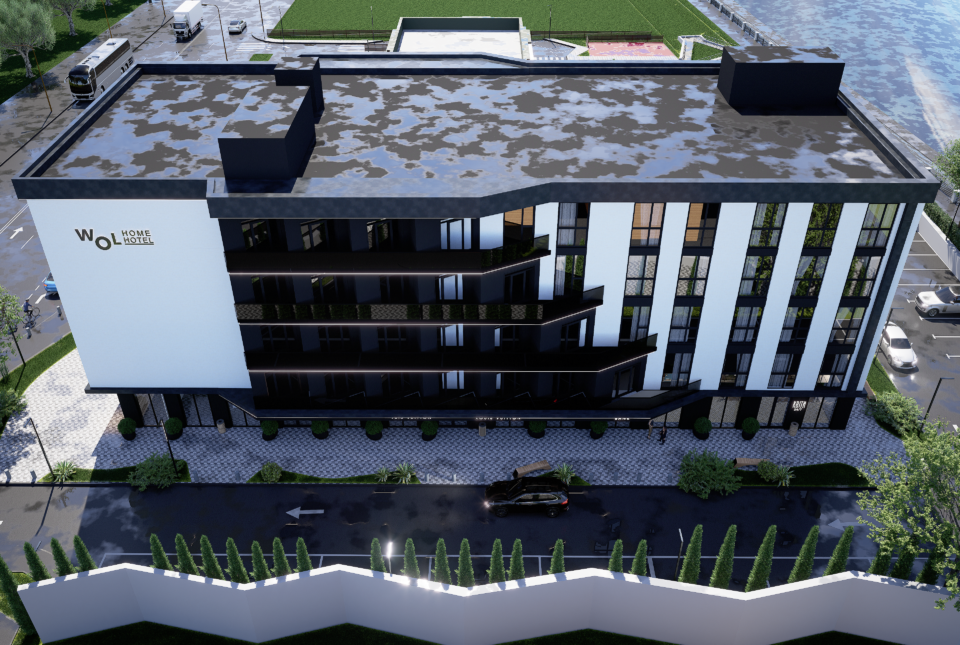

Nowadays, it makes sense to invest in smart apartments, which belong partly to residential real estate and partly to hotel real estate. They will be in demand in regions of Ukraine with a more or less stable security situation, as people move within the country and look for new housing for 3-6 months or up to a year.

At the beginning of 2022, we opened home + hotel apartments in Odesa. A client who books accommodation for a long or short term gets not only an apartment, but also access to a co-working space, a cafe, and a gym. Currently, we rent 60% of the rooms long-term (from three months), 20% – medium-term (for two to three months), and another 20% – short-term (from a few days to a month). This enables the business project to have an attractive return at the level of 8-10% per annum.

As for domestic tourism, I believe that it will be firmly established in the west of Ukraine, because even after our victory, the Azov region and the Black Sea region will be closed for some time due to mining in the water area. Country hotel complexes, which can be reached in two or three hours by car, will also become popular.

Despite the full-scale Russian invasion of Ukraine, hotel construction continues. Thus, none of the ten projects of Ribas Hotels Group and our partners has stopped. Now we continue to build three hotel objects in Ivano-Frankivsk and the region, and we are also building in Lviv and Odesa.

Of course, the situation in the south and east is completely opposite. In Kyiv, most investors took a break and do not undertake to finish what they started, if they have invested less than 50% of the funds. They are waiting for the end of hostilities to understand the new market conditions and perhaps make their hotel simpler in terms of level or, on the contrary, more expensive.

In the future, the cost of construction will only increase, as will the price of a square meter for purchase/sale. The cost price will also increase, as many regions of Ukraine will become attractive for business after the end of the war. It was the same with Croatia and Montenegro, which after the Balkan wars became one of the best international resorts.

Read the continuation of the author’s column on the website of the publication “Economic Truth”.

Subscribe to our blog to follow the hotel market of Ukraine!