What Challenges Does the Hotel Market Face?

The hotel real estate market can be broadly divided into two key areas: the tourism sector, which provides guest accommodation, and hotel development, which attracts investment and builds income-generating properties. What challenges does the industry face in 2025? And will the market be able to adapt to ongoing changes?

Author: Artur Lupashko, Founder of Ribas Hotels Group

Published in: Ekonomichna Pravda.

Human Capital as the Main Challenge

One of the biggest challenges for the hotel industry is the shortage of personnel. There is a lack of qualified and motivated professionals at both the top management and operational levels. There’s also a deficit in professions typically dominated by men: technicians, chefs, builders. The main reasons include mobilization risks and migration abroad.

To address this, hoteliers are increasing financial incentives, improving working conditions, and investing in HR branding. They also engage companies with strategic status in construction projects to provide exemption from mobilization for builders. Another important tool for attracting new professionals is training workers from scratch.

Planning Uncertainty for Investors

Currently, investors lack confidence in the country’s future. To build trust, developers and management companies need to speak openly about the risks and potential of specific regions and projects. The overall investment climate in the hotel sector remains unstable.

According to Ukraine’s Ministry of Justice, the number of real estate sales transactions across various property types dropped to 99,633 in 2022 due to the war, compared to 325,174 deals in 2021 — a 68.9% decline.

Ribas Hotels Group, in its research “Overview of Ukraine’s Hotel Market 2024”, forecasts that a significant portion (around 200,000) of the transactions not completed during 2022–2024 will turn into deferred demand and materialize over the four to five years following the end of the war.

Lack of Foreign Investment

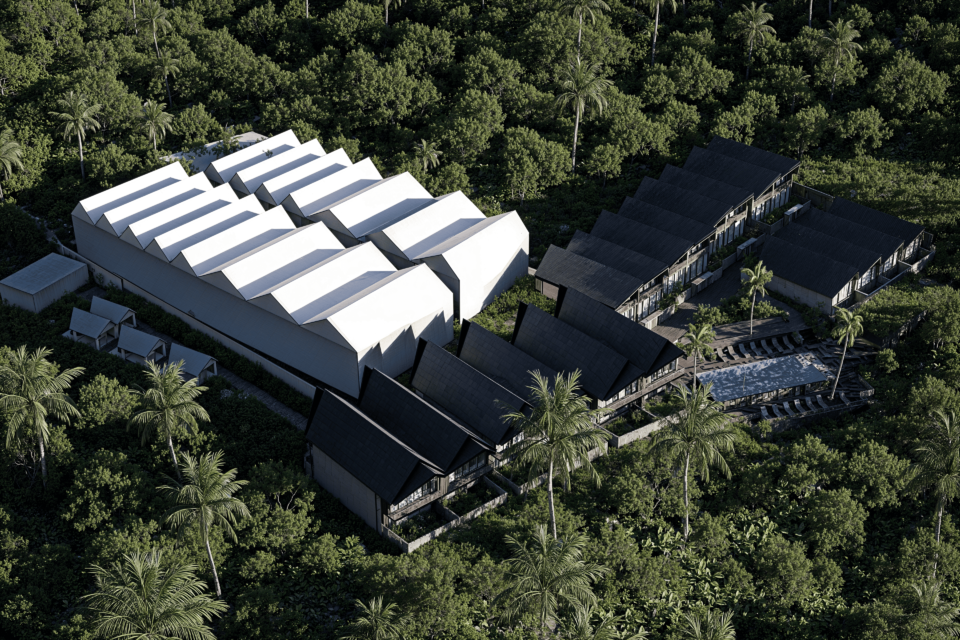

At present, Ukraine’s hotel real estate market is financed exclusively by domestic investors. The end of the war could become a major catalyst for attracting foreign investment — as seen in Georgia, Turkey, and Bali.

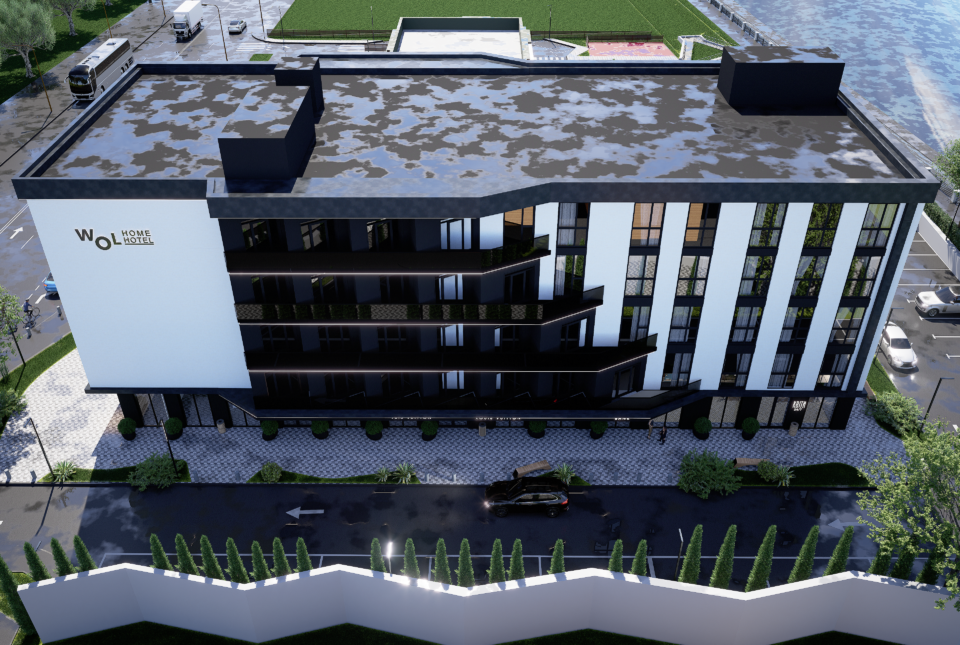

After the war ends and international tourism resumes, we expect a gradual increase in the price per square meter. This will contribute to higher average checks in USD, shorter payback periods, and more interest from foreign investors.

Currently, the price per square meter in income-generating properties ranges from $3,000 to $3,500, while the construction cost reaches $2,500–$3,000 per sq.m., driven by the high cost of land, engineering solutions, and renovation work.

Read the full article on Ekonomichna Pravda.

Subscribe to our blog to stay up to date on hospitality market trends!