Artur Lupashko: Choose Your Investment Object Carefully — Then Watch the Market

Interview published on delo.ua

Where should you invest — deposits, stocks, real estate, or your own business? These tips can feel abstract. Financial literacy grows best through practice — and real stories. Entrepreneurs, executives, and investors. In our Smart Money series, we talk to people who’ve walked the path to financial independence.

Today’s guest is Artur Lupashko, founder of Ribas Hotels Group.

Artur, when did you start investing? What advice would you give your younger self?

I started about five years ago. I would tell myself to start earlier. Initially, I invested in my own business. But that’s not pure investing — it’s scaling. Anything I didn’t personally control, I questioned.

A classic investor is the opposite of a classic entrepreneur. Entrepreneurs invest everything into their own ventures — despite the risks. Investors spread their capital and don’t influence the businesses they invest in. Their job is to choose wisely — and observe.

What’s the minimum amount someone should start with?

The amount doesn’t matter. What matters is the proportion of your income. For me, I aim to invest at least 50% of my earnings. Start small to overcome fear. At first, it felt risky to transfer funds to a U.S. broker. Even though they’re more reliable than many banks. Even when I could invest hundreds of thousands — I started with a few thousand.

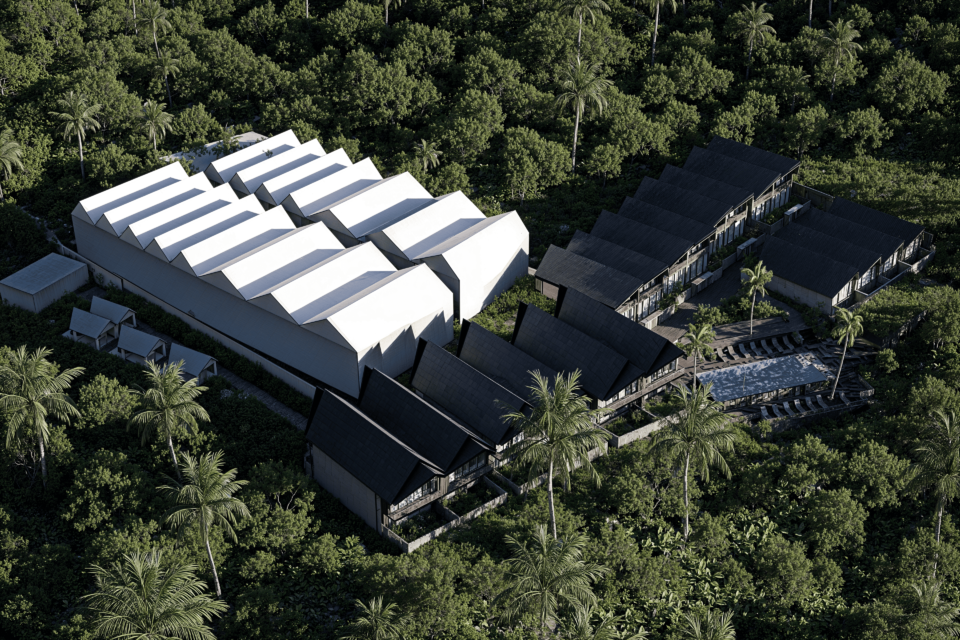

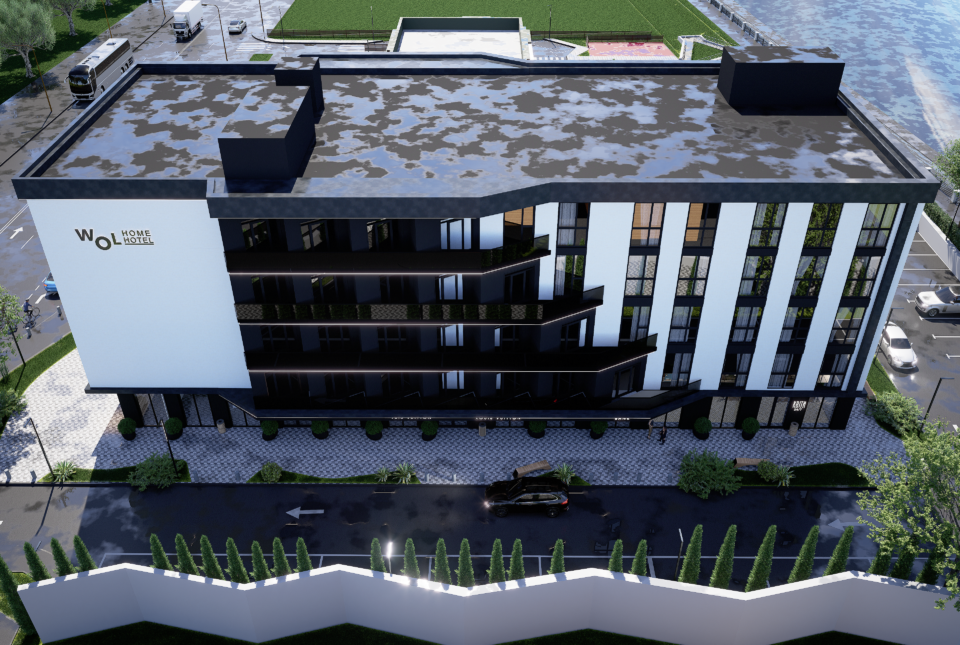

Today, our company enables investment from just 4,000 UAH through a cooperative legal model — fractional ownership of hotel rooms or restaurants, with up to 10% annual return.

First, investing protects against inflation. Second, it generates fair returns. Build your portfolio gradually: $100, $200, $500. In 3–5 years, it adds up — your pension fund or a “rainy day” reserve.

What was your worst investment loss?

As an entrepreneur, I’ve lost money on projects that failed to find product-market fit. I knew the risk and took it. But from an investor’s standpoint, due diligence is critical. Real estate seems liquid — but try selling it quickly and you’ll realize it’s not always the case.

It’s great for capital preservation and status, but not for liquidity. Liquid assets include crypto, bonds, short-term deposits. Four criteria to assess investments:

- Liquidity — how fast can you exit

- Real yield

- Risk

- Transaction costs

Examples:

— Bitcoin was profitable.

— Altcoins weren’t — too risky.

— Real estate dominates my portfolio, but I have assets delayed for six years. That capital could have doubled elsewhere.

What was your most successful investment?

Again — real estate. One asset doubled in two years. When you watch the market closely, you learn to spot winners early. In my case — hotel property. Another win — bitcoin, which we began buying at $24–25K and continue to accumulate.

What’s the safest wartime investment?

All investments carry risk during war. But in my field — hotel real estate in Western Ukraine — military risk is relatively low. Yes, income may drop due to uncertainty. But prices won’t, because construction costs are rising — and won’t fall soon.

What should people avoid until after the war?

I wouldn’t invest in someone else’s active business — especially where you have no influence. Often, that’s just temporary fuel. If someone truly believes in their business, they’ll find the funding themselves.

What could “take off” after the war, but is worth investing in now?

I believe Ukrainian securities. The stock market isn’t yet mature. But if the economy grows, stocks, REITs, and land funds could be highly profitable. Also, energy — it’s high-margin and liquid. Some companies already offer entry with low thresholds. Example: Inzhur Energy, part of the REIT Inzhur.

Any book recommendations that shaped your financial mindset?

Read Principles by Ray Dalio.

Subscribe to our blog to follow the news of the hospitality market!