Investor’s Guide: How a Hotel Operator Calculates the Payback of Income-Producing Projects

By Yulia Bodnar, Lead Investment Expert at Ribas Invest

Investing in income-producing hotel projects (aparthotels and villa communities) is a great alternative to the rental business. The management company provides a complete set of facilities from repairs to furniture and appliances and deals with attracting guests and maintaining the property itself. After deducting the property service costs, the hotel operator’s remuneration ranges from 20-25%. The rest is the income of the apartments’ owners.

Investors’ incomes in the projects can be either a short-term investment or the long game. For example, you can buy hotel rooms at the excavation stage at the lowest price and sell them later. This is due to an increase in construction costs.

The payback period for this type of investment ranges from 8 to 12 years, depending on the region and class of construction. However, a lot of companies often set unrealistic payback periods that are far from the regional average, which can confuse a novice investor. That’s why we are going to tell you what average figures you should trust and what the payback period is based on.

Factors Affecting the Payback Period Calculation

If we start working with a project at the development stage, we consider three main indicators when calculating the payback in each project.

1.Segment (premium, business, comfort). Here you should adequately estimate the cost per square meter, as it can vary depending on the segment. For example, in the premium segment, the price per square meter starts at 3,000 U.S. dollars. In this case, the retail cost is 4,000 to 6,000 U.S. dollars, and the return on investment can take about 12 years, as this segment pays off longer. However, if the complex has a developed infrastructure that often covers more than 50% of the area, the payback can be much faster. Another example can be the lower-end real estate segment with a cost of 1,500 to 2,000 U.S. dollars per square meter, which will result in a faster return on investment, for example, at 10%.

2. Time. People often ask: “Why is it that your performance in one project has a 10% annualized return, and in the other 15%? Does this mean that one project is better than the other?” The answer is that you can invest in one project at the excavation stage and in the other just before commissioning. A good example is Ama Family Resort (the village of Polyanytsia, Ivano-Frankivsk region). In May last year, a square meter in this complex cost 2,850 U.S. dollars, and now we are at the stage when the entire complex is sold out and investors are selling their apartments for 3,700-3,900 U.S. dollars/sq.m. So the growth is 800-1,000 U.S. dollars per year. Investing in projects at the excavation stage can bring more risk, but also more profit. Another example is the MALAHIT RESORT & SPA villa community (the village of Mykulychyn, Ivano-Frankivsk region), where villas started being sold in May last year at the first price of 100,000 U.S. dollars. Today, the villa starts at 138,000 U.S. dollars. And this is an increase in just one year. It is worth mentioning that in the case of cooperation with Ribas Hotels Group, the developer and the hotel operator make commitments to ensure the profit of the complex.

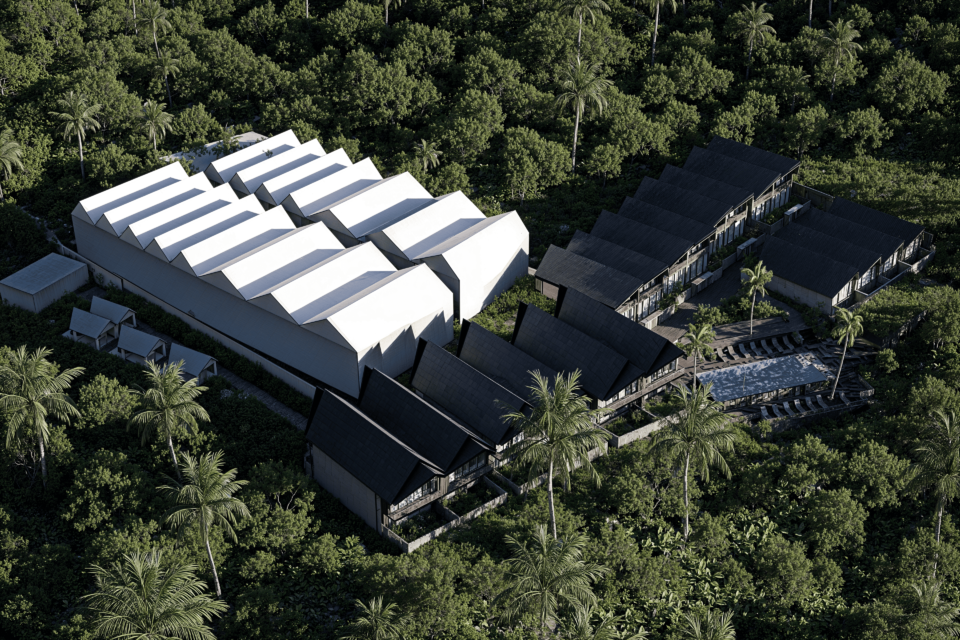

Visualized: MALAHIT RESORT & SPA Villa Community (the village of Mykulychyn, Ivano-Frankivsk region).

3. Location. Location is important. We never offer investors projects in places that are hard to reach or little known. Because even a comprehensive infrastructure package within the facility cannot compensate for limited external infrastructure options.

There are market players who do not pay attention to this aspect. They believe that it will always be there, and this can be a good strategy. However, the modern tourist has many choices of where to go. If you choose a house on top of a mountain with no roads or infrastructure, the payback may be longer, but only if people regularly visit the place.

You also need to proceed from the popularity of the location. For example, in the village of Polyana in Transcarpathia, the cost per square meter is 2,700 U.S. dollars, while in Bukovel it is 3,900 U.S. dollars. Land is cheaper in the village of Polyana. Similarly, in the village of Yablunytsia, Ivano-Frankivsk region, the price per square meter is lower than in Bukovel. This is because Bukovel is the most popular ski resort in Ukraine.

What payback figures should you trust?

When reviewing data on the payback of real estate projects, investors should pay attention to the cases of the company. This is not to find perfect forecasts, but to see real experience. For example, how the company has survived a tough season.

It’s worth noting that it’s harder to provide guests with a high level of service when the hotel is 100% booked. So it is essential to be prepared for such challenges. In our financial models, we indicate that hotel occupancy can range from 90% to 40% or even 30%, but the average is 55%. We can explain this data by pointing out that, for example, in April we had an occupancy rate of 38%, and in January — 98%.

You should also consider the average return on investment in the region you plan to invest in. For example, in the western region, which is the most stable and profitable today, the average return on investment for apartments is 10% to 13% without capitalization, and 12% to 16% per annum with capitalization. Now we get a payback period of 7 to 10 years, which is typical. As for Kyiv, the average payback period for such projects is currently 7% per annum.

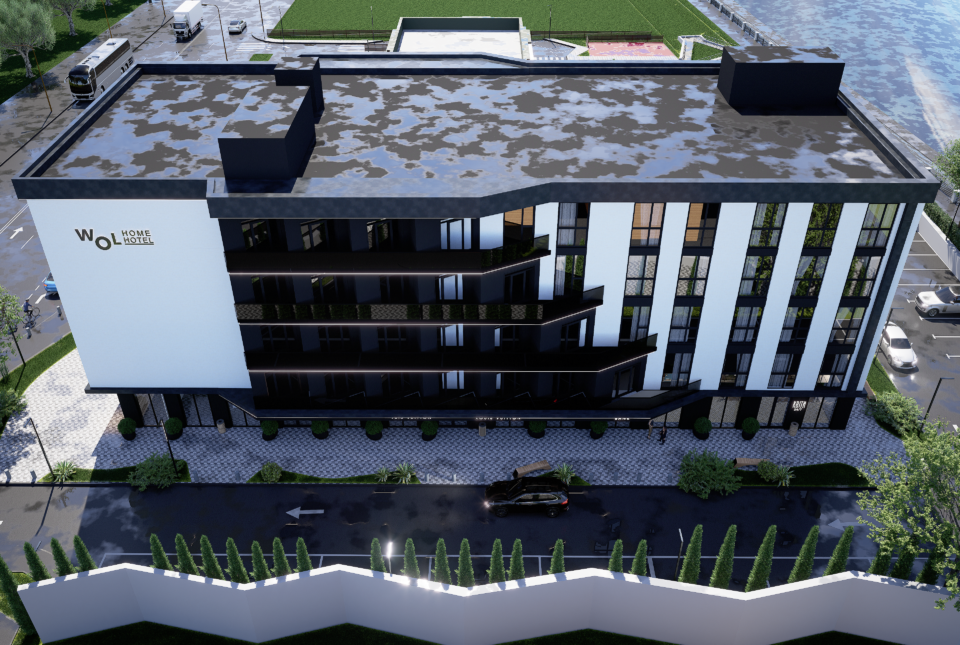

Visualized: Ama Family Resort Hotel Complex (the village of Polyanytsia, Ivano-Frankivsk region).

Working with Ribas Hotels Group, a hotel operator, and Ribas Invest, a company selling income-producing real estate, managed by Ribas Hotels Group, has its advantages, because it is a brand, and whether you are in Odesa or Bila Tserkva, the concept may differ, but the service and approach to work do not, because they are controlled by the same management company. This is also why people trust Booking.com when they book rooms there. They know that in case of any problems, they can turn to this company for help and they will not be denied. In our case, investors and guests can contact the Ribas Hotels Group management company or Artur Lupashko, the founder of Ribas Hotels Group, personally if they have any questions.

As an affiliate of Ribas Hotels Group, we at Ribas Invest analyze the customer’s goals, budget and other criteria to find the best stage, cost and installment plan. If there is an installment plan, we alsoconsider how it fits the customer’s needs. You can find the full list of available investment projects on our website invest.ribas.ua

Subscribe to our blog to keep up with market news!