Investments in hotel real estate: what about prices and how to choose profitable objects

The article was published in the online edition of Economic Truth.

In the next 5-10 years the center of domestic tourism will be the west of Ukraine. Many investors have already started investing their money in hotel real estate in Ivano-Frankivsk, Lviv, Zakarpattya and Ternopil regions.

The main and obvious reasons for this reformatting are large-scale mining of the Black and Azov seas and significant destruction of resort towns under temporary occupation.

The current demand is difficult to compare with pre-war figures, as even in the western region it has decreased, but market experts give it a positive outlook for development.

Let’s take a look at how hotel real estate investments work and what investors need to consider when choosing properties.

EU accession and rising construction costs: how the cost of hotel real estate in western Ukraine will change

We predict that in five years real estate in the west of Ukraine will cost twice as much because this region is safer.

In addition, the price will also rise due to Ukraine’s gaining the status of a candidate for EU accession. Prime Minister Denys Schmigal said on Europe Day that Ukraine would be ready for accession in 2025.

Increasing development norms, limited land availability, and rising construction costs will also affect costs.

In particular, earlier it was possible to build an object from brick or concrete for 300-400 dollars per m2, today the cost has risen to 400-500 dollars per m2. The cost of repair and finishing is 700-1000 dollars per m².

Taking this into account, we have analyzed the real estate market and see that the cost per square meter in apart-hotels or cottage towns in development projects is already growing annually by at least 10-15%.

Five to seven years ago the price of fully equipped apartments in Bukovel ranged from 1000 to 1500 dollars per m2. Currently, the current prices are from 2500 to 5000 dollars per m².

On the visualization: hotel complex AMA FAMILY RESORT

What prospects there are for investors in the western region

We analyzed 30 properties located in western Ukraine from the point of view of their attractiveness both for an investor and a hotel operator.

There are few competitive objects in the list. For example, the developer of Apart Hotel Garda in Bukovel does not give any forecasts regarding profitability for the investor, all the advantages are reduced only to the fact that this region basically assumes a high workload.

It should be noted that from the infrastructure on the territory there is only a restaurant. This is an important detail, as potentially the hotels should expand their infrastructure, for example Phoenix, which is also located in Bukovel.

A large-scale infrastructure is being built around it: vats, baths, saunas, salt room, hospital, helipad, recreation areas, skating equipment rental, restaurant, SPA, children’s playground.

In general, those projects that do not have a management company or have not entered into an agreement with a hotel operator cannot confidently claim any profitability or payback rates.

Investing in an object with a hotel operator is safer and more profitable, as the latter has its own technical requirements for projects, and therefore does not work with every developer.

The selected hotel operator’s properties are potentially interesting and liquid, as the goal of investors and the hotel operator coincide – they seek to make a profit.

The hotel operator analyses what will happen to the project in the future, how competitive it will be, whether it will meet the market conditions within 5-10 years.

Therefore, the investor can get true information about how the management will take place, familiarise himself with the contracts, profit distribution formulas, which clearly spell out all the points of responsibility assumed by the hotel operator.

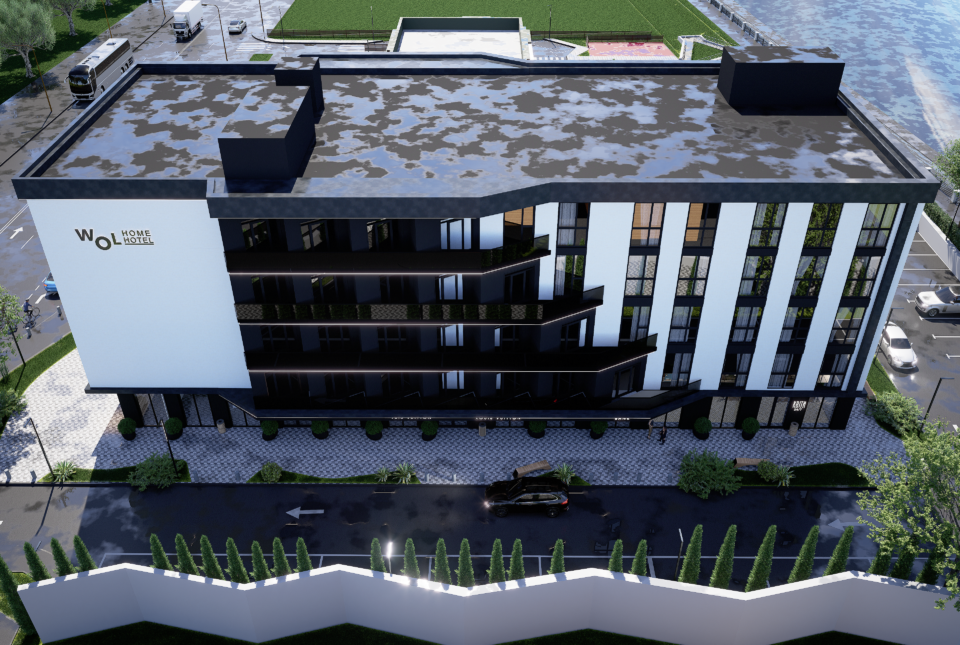

On the visualisation: apart-hotel WOL.GREEN POLYANA

Existing hotel property investment tactics

There are two tactics for investing in hotel property: passive income and resale.

Passive income assumes that the investor first participates in financing the construction or buys part of the property, and over the next 10 years receives a cash return on the deposit.

The income in such properties is generated from the rental of real estate properties by end users and distributed to investors based on the results of the financial year.

The advantages of this tactic are income stability, relatively low cost of entry from $10,000 and the availability of a management service.

Resale of the property is attractive because an investor can make a quick profit by selling his room as a ready-made business. We predict that due to the high rate of appreciation of property values in the near future, demand for apart-hotels will grow faster than, for example, for residential buildings or commercial premises. This may lead to an increase in the value of the property and the possibility of resale at a profit.

Read the continuation at the link in the online edition of Economic Truth.

More details at the link about investments in hotel real estate.

Subscribe to our blog so you don’t miss out on interesting content on the topic of investment and hospitality!