The number of guests in five-star hotels is growing despite the war. Why is it happening?

The article was published in the online edition of Ekonomichna Pravda.

Hotels, cinemas, gyms and shopping malls are among the businesses that have been hit hardest by the coronavirus pandemic, and the great war has pushed them to the brink of bankruptcy.

The hotel business had just begun to recover from the knockout blow when the Russian occupiers invaded the northern and southern regions of Ukraine. However, even after 1.5 years of war, hotels continue to operate.

Only domestic tourists and foreigners working in Ukraine bring them income. Businessmen whose properties are located in the western regions earn more.

How does the country’s hotel industry survive?

Three market phases

According to the State Agency for Tourism Development, there are no accurate statistics on hotel occupancy in Ukraine. To have it, it is necessary to adopt the draft law “On Tourism” and introduce a data collection system. “We don’t even know how many hotels there are in Ukraine. The new law will require hotels and other accommodation facilities to submit monthly data on their occupancy rates,” the agency said.

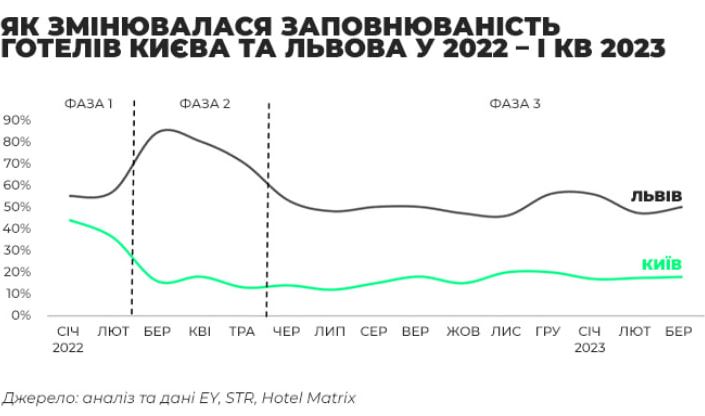

EY Ukraine’s real estate advisory services experts have identified three phases in the hotel real estate market starting in 2022, depending on changes in demand.

The first phase lasted from January to 24 February 2022. It was characterised by high demand for hotels. Occupancy rates during this period exceeded those of 2021, and in some regions, even pre-quarantine years.

During this period, the average level of demand for hotels in Kyiv increased. In January-February, occupancy rates increased from 30% to 40% compared to the same period in 2021, and in the high-priced segment (5 stars), the rate increased from 21% to 33%.

Zavdyaki easing of quarantine restrictions and increase of tourist flows in the rіvennyuvannosti zrіs і near Lviv – from 35-40% to 55%. In Kharkiv, in 2021, the average rate of hotel inventory in 2021 will be 35-45%.

The second phase began on 24 February 2022 and lasted about three months. During this period, many hotels in Kyiv were closed, and those that were open had rather low average occupancy rates of 10-20%.

“A hotel is a round-the-clock mechanism. In a crisis situation, you need to act quickly, taking into account all factors. At that time, we arranged for our guests to be relocated to partner hotels that could continue their full operational activities,” said Diana Batyshcheva, Commercial Director of Holiday Inn Kyiv.

Instead, five-star hotels had good occupancy rates due to increased demand from media representatives, diplomatic delegations and international volunteer organisations, says Rostyslav Khoma, head of real estate advisory services at EY Ukraine. “The performance was better than before the great war. The average occupancy rate of five-star hotels in March-May 2022 was 37%, compared to 27% in the same period in 2021.

In contrast to Kyiv, the western part of the country saw a significant increase in demand during this period. Many hotels were fully booked for several months, which led to an increase in average occupancy in Lviv from 30% to 80%.

“After the start of the great war, the occupancy rate in the western regions was at its highest, but it was not tourism. It was a forced relocation of people from different regions to find a safe place or stop on the way to the border,” says Yulia Kosenko, Chief Operating Officer of Ribas Hotels Group.

The situation was the opposite on the eastern borders. Due to active fighting near Kharkiv in the spring of 2022, the average hotel occupancy rate was close to zero.

The third phase, which began in the summer of 2022 and is still ongoing, was characterised by the return of internally displaced persons to their places of permanent residence.

During this period, the average occupancy rate of Lviv hotels began to decline and stabilized at 50-60%, which is in line with pre-war 2021.

Occupancy rates in Kyiv hotels stabilized in early June and remained at 15-20% until March 2023. According to EY and HotelMatrix, the average hotel occupancy in Kyiv in 2022 was 22%, compared to 50% in 2021.In Kyiv, occupancy stabilized in early June and was 15-20% by March 2023. According to EY and HotelMatrix, the average hotel occupancy in Kyiv in 2022 was 22%, compared to 50% in 2021.

According to the State Agency for Tourism Development, the average room rate in Kyiv hotels was UAH 2,182 in April and UAH 1,636 in September. These are the highest and lowest figures of 2022.

Overall, in 2022, the supply of hotel accommodation in Kyiv exceeded demand by five times.

“The growth in occupancy began in September 2022 as a result of the start of events and mini-groups. This trend is continuing. The shelling of Kyiv in October was a turning point in the occupancy rate for individual guests,” Batyshcheva says about the situation at Holiday Inn.

Photo source: GETTY IMAGES

In the first quarter of 2023, the average occupancy rate in five-star hotels in the capital was 28-40%, which is higher than in the same period in 2021.

Tourism began to recover in the summer and was concentrated in the western regions, which were safer at the time, Kosenko says. In Odesa, hotel occupancy dropped because it was a frontline city.

“In autumn, business and weekend tourism began to recover. Then the occupancy rate increased and levelled off. Now it is difficult to predict it due to the shorter booking window: guests are more likely to book rooms a day or two before arrival, but in general, the dynamics are positive,” says a representative of Ribas Hotels Group.

According to HotelMatrix, the average occupancy rate of Odesa hotels was 22% in 2022 and 47% in 2021. The average revenue per room was UAH 1,369 in November and UAH 850 in May. These are the highest and lowest figures for 2022.

The western regions, on the other hand, experienced an increase in occupancy due to the formation of new target segments: international organisations and IDPs.

“Occupancy in Lviv in 2022 was 54%, 6% higher than in 2021, and in Bukovel – 58% compared to 60%. In 2021, there was a tourist boom in Bukovel thanks to tourists from Saudi Arabia,” says Olga Mishchenko, Project Manager at HotelMatrix.

The highest average revenue from renting a hotel room in Bukovel was in December – about UAH 4,500, and the lowest – in May – UAH 1,250.

After the de-occupation of the Kharkiv region, the occupancy rate of Kharkiv hotels increased slightly and fluctuated between 15-20%. This is half the pre-war level.

The rest of the article can be found in the online edition of Ekonomichna Pravda.

Subscribe to our blog so you don’t miss interesting facts about hospitality!