Hotel rooms purchase: investment risks and benefits

Buying apartments in hotels is a common practice abroad, less often in Ukraine. It is an attractive way to invest capital, combining the advantages of real estate and business while reducing the need for personal management. The scenario is extremely simple: the investor buys a room in an apartment hotel, the management company is engaged in renting it out, and they divide the income between each other. There are two systems. The first option – the depositor receives a fixed income, which is negotiated with the hotel operator. In this case, the amount of profit does not depend on the number’s occupancy. The second option the depositor receives income at a floating rate. In this case, the profitability of the number may be higher, but there is always a risk of low demand.

Benefits of investing in hotel rooms

- Adequate cost. The main advantage of investing in apartment hotels is a relatively low purchase price, commensurate with the purchase of an apartment on the secondary market. For example, the cost of a hotel room in Europe starts from 100,000 euros. In Ukraine, it starts at about $45,000 for apartments that are renovated and furnished, ready to live. Thus, hotel apartments are one of the best investment projects for those who want to invest funds in a business with high profitability.

- Does not require management. One of the key advantages of investing is professional property management. The management company takes care of all rental, maintenance, and marketing issues, allowing the investor to avoid day-to-day operations and reducing the risk of room vacancy. Investing in a hotel room does not provide for the disposal of this property, but the investor acquires the property as private property and can sell it back to the management company or another investor at any time. This format can be convenient for investors who have a core business. Such depositors consider the purchase of hotel apartments as an additional profitable asset or as an alternative to less reliable bank deposits.

- Stable income. The average profitability of hotel rooms is 10-15% in the case of a floating rate, 8-10% – fixed. However, the choice of the object should be approached responsibly: it is necessary to study the hotel operator, predict the prospects and get acquainted with the location of the hotel on which the price of a hotel room may directly depend. These criteria are important when choosing an investment project related to the hotel sector.

In many countries, the culture of apartment hotels has been widespread for a long time and ranks among the top investment projects. However, the first person to develop the concept of this idea was Jack De Boer. He opened his debut facility in 1975 in the United States (Wichita, Kansas).

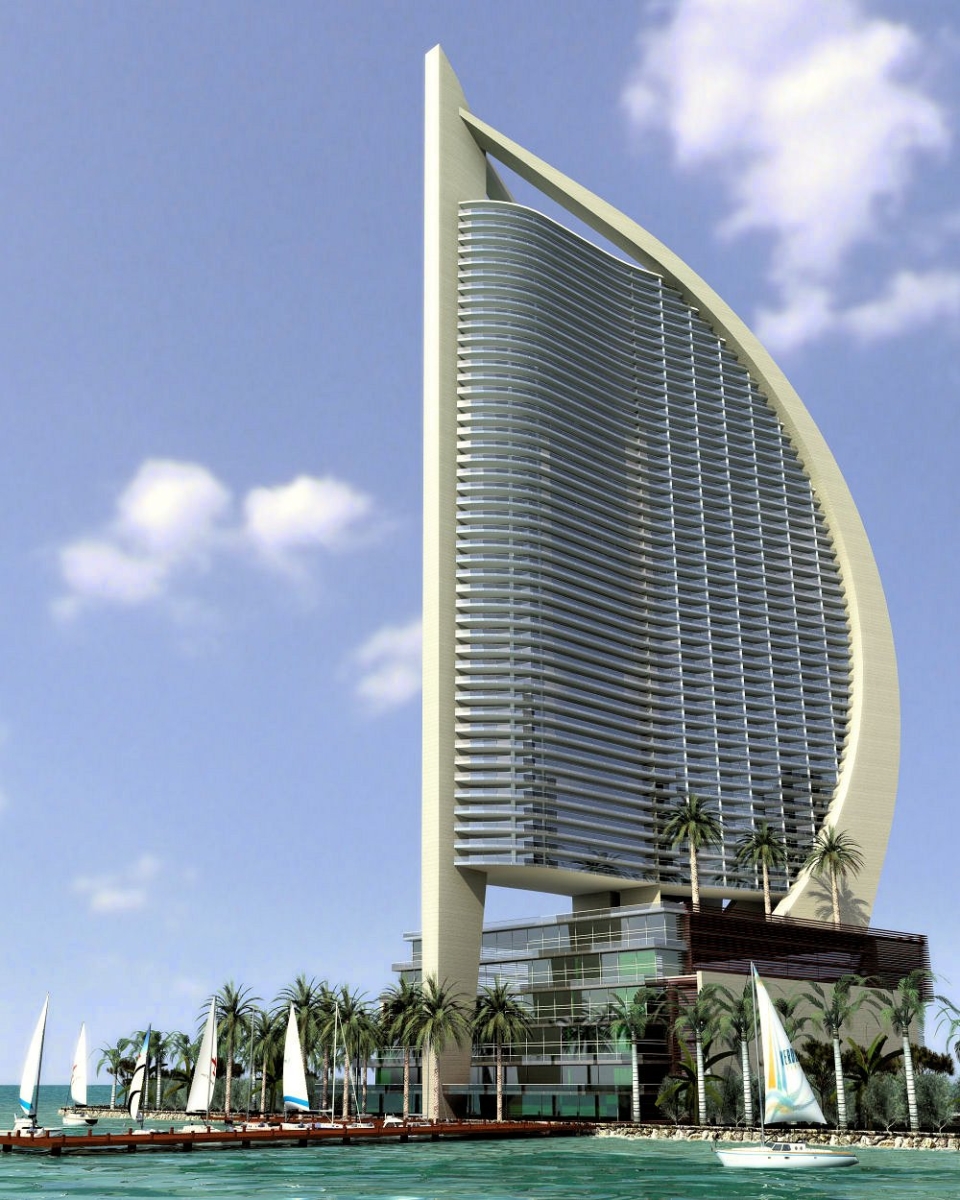

However, this format began to be particularly popular in the United States in the 1980s and 1990s. This happened because of Donald Trump and the Marriott International hotel chain. Today, investing in this type of real estate is becoming more common all over the world. Until now, the driving force of this direction is considered to be the Trump Organization – the family company of Donald Trump. In Panama City (United States) they have opened another complex – Trump Ocean Club International Hotel&Tower, the cost of which is $270 million.

In Dubai (UAE), for example, the trend of investing in hotel rooms started about 8 years ago. In comparison with traditional hotels, they offer more profitable medium-and long-term contracts and help to diversify the offer and attract a different category of guests. In addition, they are less susceptible to seasonal fluctuations of demand.

Risks of investing in hotel apartments

- The contributor does not affect the management. If the hotel operator decides to re-profile the hotel at some point and it turns out to be inefficient, the investor will not affect the managers in any way. Taking this fact into account, when investing, it is better to give preference to hotels that are in the portfolio of large chains.

- Risks of no income at a floating rate. Even at the conclusion of the transaction, it is necessary to carefully study the hotel in which the investment is planned. So, when choosing an investment object, you should also take into account its seasonality. Since hotels intended for recreation, in a certain season have a low income, unlike hotels that accept business tourists and have a stable profit all year round.

- Long-term cost increase. The cost of a hotel room, in comparison with other types of real estate, is growing much longer. This fact confirms that such investments are designed for a long term and require patience to achieve profitability in the hotel business.

Thus, investing in the hotel business by buying a hotel room can be a profitable investment. However, this idea also has its pitfalls, which the investor should be aware of.

To reduce potential risks, investors are advised to diversify their investments—by investing in different properties or regions—and to carefully analyze the demand and seasonality of a specific hotel.

Investing in aparthotels in Ukraine: prospects and recommendations

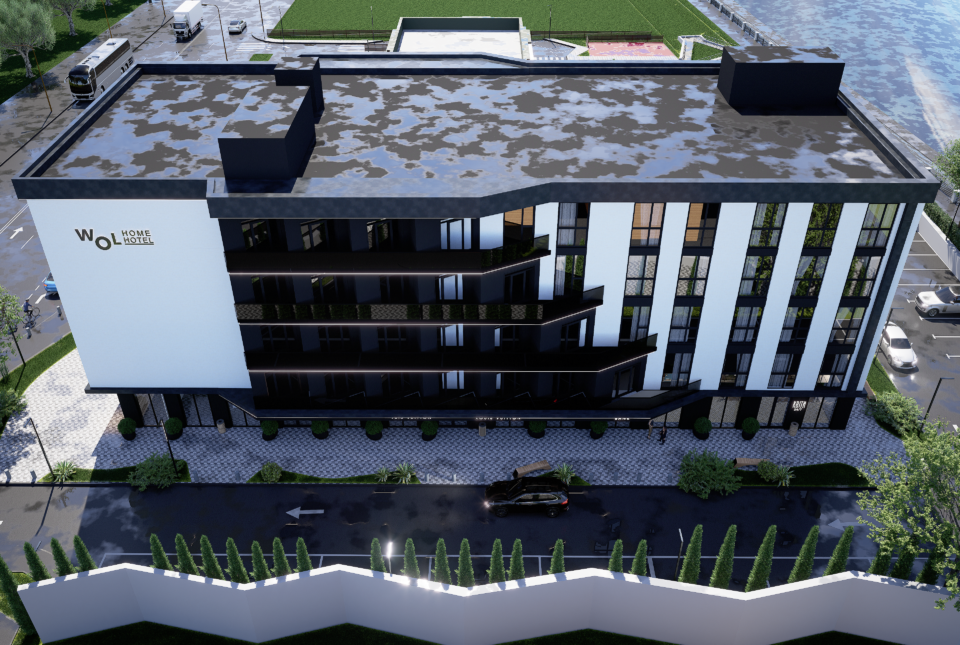

In Ukraine, the trend of investing in apartment hotels is just beginning to emerge, but among the representatives of such objects on the Ukrainian market , one can distinguish S1 Terminal (Kiev), Lev City Hotel (Lviv), Maristella Marine Residence (Odessa), Polyana Residence and others.

When choosing an investment property, it is very important to pay attention to the management company. The operator’s reputation, experience, and transparency of financial reporting directly affect the profitability and security of the investment. The contract with the management company should clearly specify the terms of profit distribution and the responsibilities of the parties.

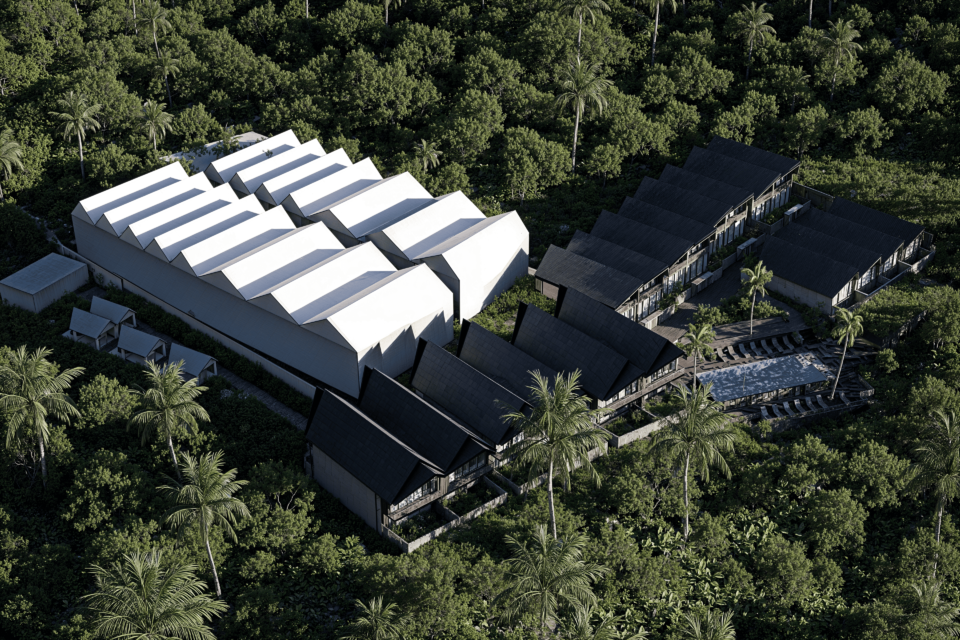

It should be noted that the hotel management company and hotel chain Ribas Hotels Group has also launched this direction and will soon provide an opportunity for those who want to start a business with a capital of $45,000 or more to purchase rooms in apartment hotels in the main resort regions of Ukraine with a guaranteed annual return.

You can also contact our company for advice on investing in hotel rooms and also calculate the cost of a room in a mini hotel, and receive assistance with other investment projects.