Ribas Hotels Group research: the market of profitable hotel real estate is developing rapidly

Ribas Hotels Group is actively working on the development of the income-producing real estate segment in Ukraine. Based on its experience, the company has conducted a market research of profitable hotel properties.

Thus, the growing popularity of branded service apartments and condo hotels is driven by covid changes in the commercial real estate market. Such projects are scaling up quite quickly. In 2020-2023, ~47 apart-hotels projects selling rooms and apartments are at various stages of implementation in Ukraine, and only 3 such projects have been implemented in the previous 28 years of the country’s independence. The rapid development of new formats is observed in tourist/recreational regions (especially Lviv and Ivano-Frankivsk regions), and not only in megacities, as before.

In the photo: AMA FAMILY RESORT condo hotel (Polianytsia village)

It’s worth noting that the alternative investment market is also showing growth, with specialized funds and platforms emerging to facilitate investment in serviced apartments and condo hotels, making it more accessible to different classes of investors. And short-term rental platforms such as Airbnb and Booking have made access to apartments and condo hotels easier and more convenient, increasing their popularity among travelers.

Service apartments and condo hotels offer higher yields (10-15% per annum) than conventional rental apartments. The average return on investment is 7-8 years, even with an average annual occupancy rate of 50-60%. In addition, service apartments and condo hotels provide investors with the opportunity to combine their own use and short-term rentals. This rental flexibility can make investments more attractive. And modern technology and professional hotel management can provide investors with greater security and convenience in managing their properties.

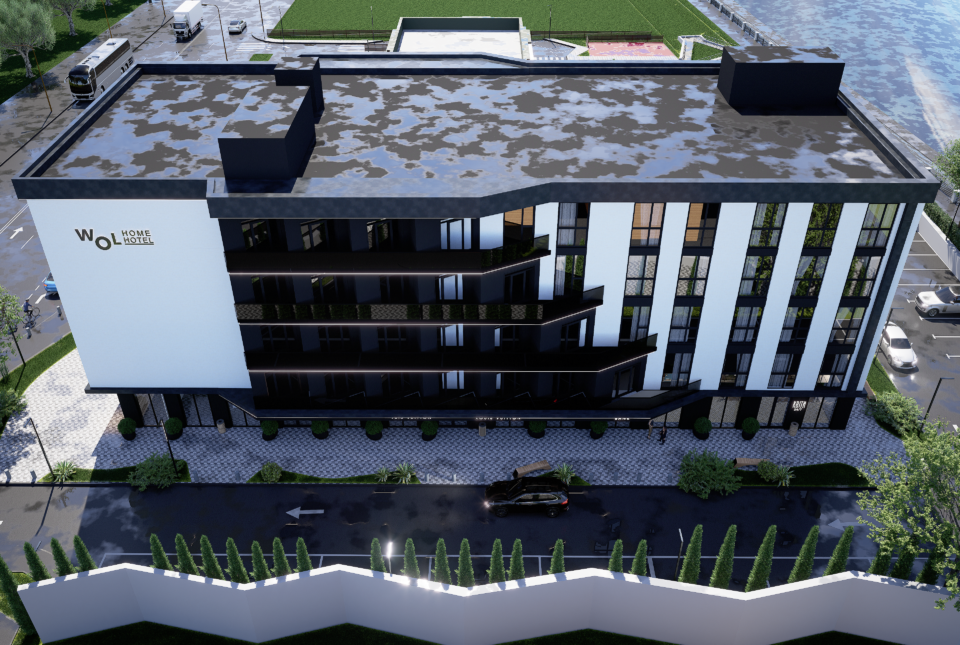

On visualization: LOGOS HOME APARTMENT condo hotel (Yaremche)

In addition, the global market is striking in its dynamics:

- In 2002-2012, the number of participants increased 10-fold, with 80% represented by hotel brands (55% from the luxury segment, 25% = upscale/midscale).

- Branded offers provide an average premium to the unit price of about 30%.

- In 2012-2022, the supply increased by more than 150%. Today it is >100,000 branded units in 640 projects.

- About 1,100 projects will be implemented by 2027. The most popular cities are Dubai, Miami, New York, and London.

The study used data from the World Bank Travel and Tourism, Hotel Franchise Development Cost Guide, Hotel Matrix, our own data at Ribas Hotels Group, as well as information from the State Border Guard Service, the State Agency for Tourism Development, the State Statistics Service of Ukraine, and the Ministry of Community, Territorial and Infrastructure Development of Ukraine.

Read more about this market in our research “Overview of the income property market”. You can get it in our chatbot at @income_property_bot