Where can I find money to start a business? 5 sources from Artur Lupashko of Ribas Hotels Group

You can hardly find a more relevant question in the business environment.

It is regularly asked to the General Director of the management company Ribas Hotels Group, Artur Lupashko. He shared the main fundraising channels and arranged them in the MC TODAY column.

First of all you should start with a question to yourself.

A rather unexpected question:

Are you sure you need money?

If the answer is Yes, it would be a good idea to sort out exactly what they are needed for.

The first money can be from initial sales and advances. As it turned out for me: I took hotels in the service for occupancy. From the funds that came from prepayments, I rented an office, rented computers, and paid salaries.

One of my friends paid to the sewing shop to create first small batch of clothes.

In both examples, the first was a sale in which we invested funds and an overwhelming desire to get the start-up, incredibly important, perhaps the most important money.

Friends, relatives

Most likely, you already have an investor in your environment. This means that you have an absolute head start: the ‘dating’ stage has already passed. You have a lot more credibility than a man from the street. Of course, this works if your reputation is not tainted and you are not noticed in the connections that discredit you.

Share your idea with anyone who might be interested. Having spoken it to your friends and acquaintances, you will at least polish it. But the goal is still to attract money, not praise. My good friend in his 19 years, intuitively understood this, and with the permission of his parents – met with all their friends and offered to sell coffee on wheels.

How it was supposed to work: he came up with the idea to re-equip trucks and move from point to point, depending on the peak congestion, without any permits from the city Council for renting a property. In the first half of the day, it was based near business centers and universities. After lunch-in the city center. So he received funding from a school friend’s father and launched one of the first coffee on wheels projects in the city. I and each of us have a lot of similar stories.

Private investors from related businesses

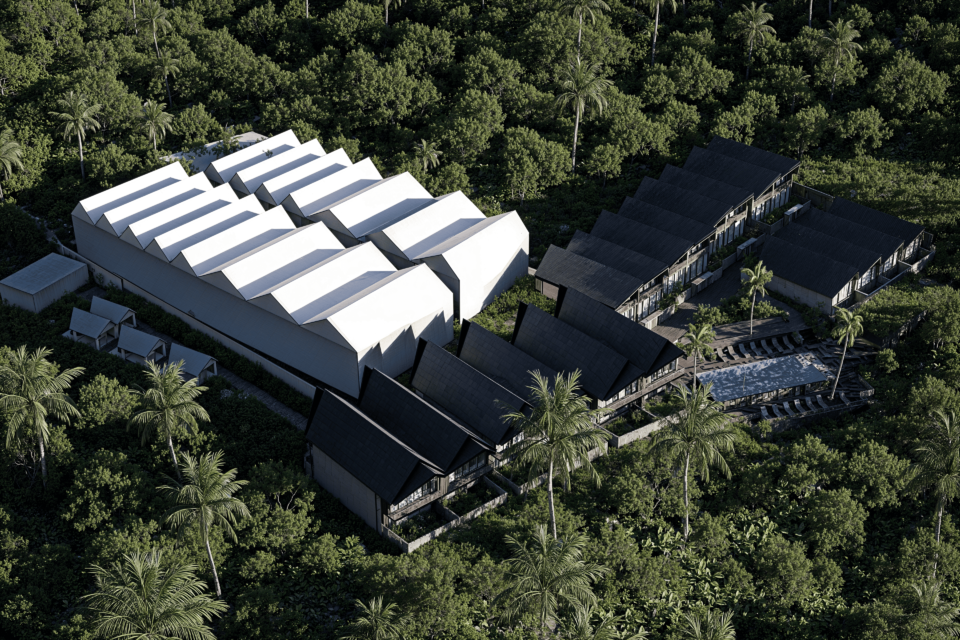

Every entrepreneur sees a lot of opportunities to earn money in related businesses that they intersect with in their work. For example, as a hotel management company, we are interested in such areas as construction, furniture manufacturing, mini-perfumes, chemicals, laundry and dry cleaning services.

As a hotel management company, we launched an enterprise that provided Internet promotion services. After two years, we closed it, because we focused as much as possible on the main business, and I did not find a managing partner who could develop this business without my involvement. Today we are engaged in the design and construction of hotels. Both companies are separate businesses with their managing partners.

A large system enterprise can already afford to engage in related businesses. But becoming a co-founder without surgery is what you need. Therefore, I advise you to find related areas, go to the top with your own business proposal. Prove that you are the one who should be trusted with your money. And it’s likely that your partner will also be your first client.

Private loans

The first two options will entail the division of the constituent share. If your share is not worth anything at the start-up stage, then when the company is already making some stable profit, each percentage has weight. And when it has a selling value, then every 0.1%. I do not recommend taking a partner who carries no other value than the first money.

It is possible to get money at 1.5-3% per month. This is a considerable 18-36% per annum. But, as a rule, at the start, these pilot investments are not enough for a short 3-6 months.

My close friend is engaged in micro – credit business. He started with a franchise office in a small town near Odessa. This business has a fast money turnover. He issued a micro-loan on bail, in 2-3 weeks the Deposit is taken away. In a month, it can earn 5-7% of the turnover. He was not afraid of risk, to lend at 2% a month and today manages more than 20 offices in the Odessa region in small towns and district centers. Plans to raise up to 500,000 Yandex units this year. and to re-credit new pawnbrokers who will already open branches in other regions of Ukraine under its franchise.

Investors from funds, venture capital, banking

Have you heard about the world’s top investors? 500 Startups, FundersClub, GV, Plug and Play, Startup Wise Guys, General Catalyst and others. Most of the funds are from the United States, Estonia, and Britain. Many Ukrainian startups have successfully used their help. N / a Grammarly, Paywall, bpm online, Genesis, Readdle, and Jooble. Ever heard of them?

Periodically, business accelerators conduct a selection among Ukrainian companies and invest in the lucky ones on average from $ 100k. 500 Startups conduct recruitment four times a year, others – less often. But keep in mind that most funds ask for a share of 6-8% in return.

If someone is interested in this source, write to me and I will share a list of ventures and other teams that are most loyal to Ukrainian entrepreneurs.

Myself

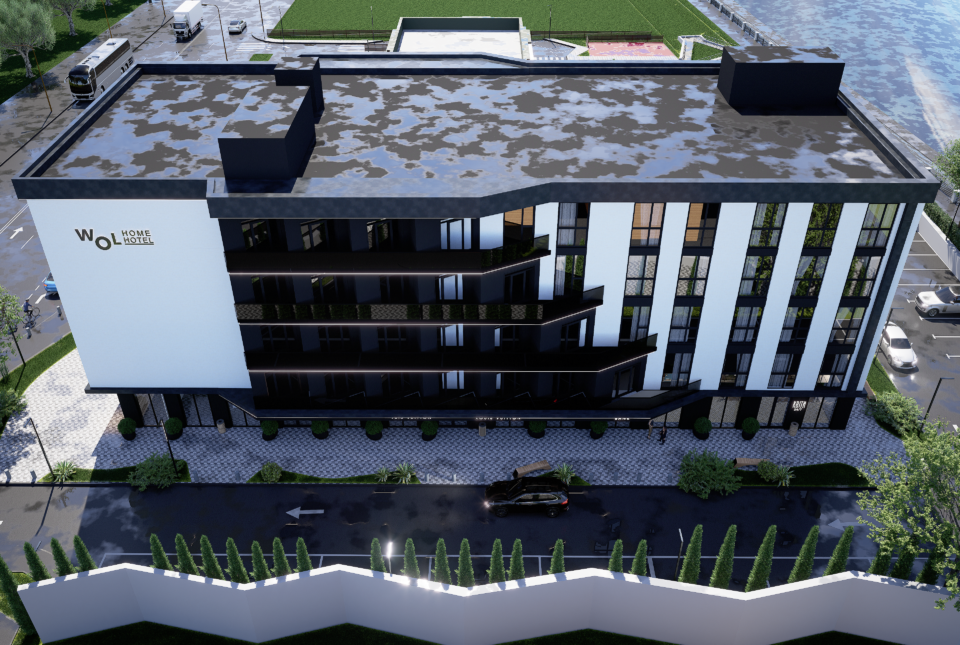

In my environment, there is a person who is ready to invest 1 million USD in a start-up project in the field of HoReCa. For him, the team, product and experience are important. So if you have your own project, let’s communicate.

Also, if you need help finding a co-investor to launch a hotel facility, our company helps future partners find each other. Address.