Instructions for investors: how to choose an apartment hotel for investment

Text: Yana Kuznetsova, CEO of Ribas Invest

The article was published on 44.ua

Investors are increasingly choosing to buy m2 in apart-hotels and cottage communities instead of buying an apartment. The reason for this is that commercial real estate is more expensive and more attractive for investment than residential real estate. Usually, the value of such objects is increased by their location, as they are located in developing tourist destinations.

In addition, there are requirements for hotel real estate: infrastructure, service, modern renovation, and a unified concept. Thus, by purchasing an apartment or cottage in a profitable complex, an investor gets a share in the business, which will always be more valuable than an apartment that he or she owns on his or her own.

An apart-hotel is a ready-made business concept, a single operating facility, and, most importantly, security, as profits are paid on the principle of equal distribution of funds to all investors, in proportion to the square meters purchased. Accordingly, all investors have equal conditions.

Define the request

When choosing an object for investment, you should first of all consider what you want to get from this object. There are two types of investors.

The first type is the one who sees profitable real estate purely as a tool for making a profit and does not plan to vacation there. In this case, they can generate income in two ways – by receiving dividends from the delivery of the complex or resale. Thus, in the latter option, the investor will purchase real estate at an early stage of construction and buy at a more favorable price to resell at the stage of appreciation. In such cases, he will be primarily interested in the cost and the actual area for resale.

The second type of investor is the one who wants to invest in a project and receive all the benefits it provides. In this case, the investor combines two of his or her needs: recreation and profit. This article is for them.

Visualization: Melis apart-hotel (Yablunytsia village)

What to look for when choosing a property?

When it comes to investing in the hotel business, it is necessary to consider various aspects that affect the success of the project. Let’s talk about the most important ones.

- Location. Among the general factors that should be taken into account when choosing a complex for investment, the location is the first thing to highlight. It should definitely be touristic. It can be a place that is just developing but has good prospects. This is important because the location always adds value to both the square meter and the average accommodation rate.

A management company with a name and experience is an indicator of whether everything is well chosen. We always analyze the market and understand which locations will develop. Currently, positive dynamics are observed in the west of Ukraine – in Lviv, Yaremche, Bukovel. This is a safe region where a new era of hotel products is being formed, replacing hut-type projects and characterized by modern design and diverse infrastructure.

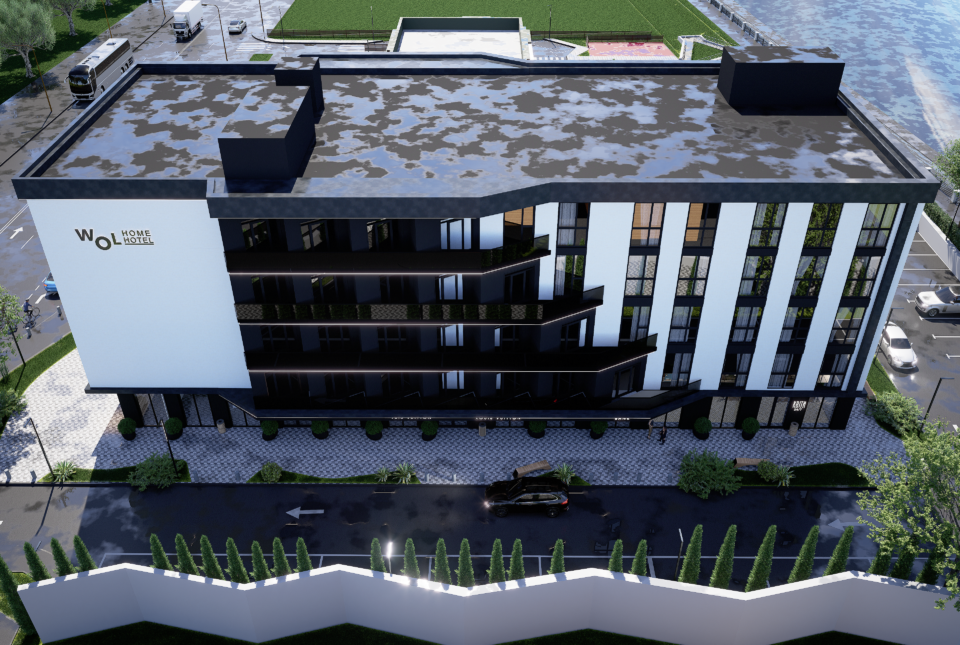

The hotel must have the right concept to ensure that it is filled in the off-season. For example, as in the Odesa apart-hotel WOL.121. However, an investor should also have a basic understanding of the development prospects of Ukraine’s regions for several years to come. For example, there is a trend toward active tourism in western Ukraine.

Проте і в інвестора має бути базове розуміння перспектив розвитку регіонів України на декілька років вперед. Наприклад, нині спостерігається тенденція до активного туризму на заході Україні.

- Concept. You also need to pay attention to the concept of the complex: what it is about, what infrastructure it includes, what it looks like from an architectural point of view, what the design and content of the rooms are. This will also influence the choice of guests. For example, in the new Melis project, which we are building together with Numo Development, we will adhere to a 45/55 ratio, where 45 is infrastructure development and 55 is apartments, instead of the usual 30/70 ratio.

- Legal aspect. Before investing, it is imperative to review the developer’s permits. In addition, it is worth checking its reputation, finding out what objects it has implemented, what team it involves in the implementation of the project you are interested in.

- A professional management company. The management company should have a professional approach to product development, implementation, and support. You should not trust it without delving into certain aspects. In particular, we advise you to pay special attention to the realism of the projected payback period, as well as whether the reserve fund is taken into account. If not, it affects the rate of return on investment.

Visualization: Melis apart-hotel (Yablunytsia village)

A selection of important questions to discuss with a hotel operator before investing

It all starts with asking the right questions, and they are an important part of working with a hotel operator before investing. Among the most important and basic of them are the following:

- Form of ownership: What will I own? What can I do with it? What rights and obligations do I have? What does cooperation with you entail?

- Responsibilities: How do we legally document what rights and responsibilities everyone has? If you’re running the hotel, what does that clearly entail? Give me a list of your responsibilities and a mechanism for how I will monitor the financial statements, the condition of my rooms, and the payments that will be made.

- Opportunities: When can I come? How much time per year can I vacation for free?

- Resale: If I want to resell my property, what are the resale conditions?

- Finance: How exactly do you calculate the financial modeling? What is it based on? What is the payback period? Have you included a reserve fund? How do you calculate costs? Are there any additional costs that I might have to consider?

Distribution of areas of responsibility

Usually, management companies offer a comfortable interaction for investors – a turnkey business with complete freedom from operational management.

During such cooperation, an entire team works for the investor: financial, legal, sales, operational, and strategic management departments.

For example, we offer investors to monitor their current financial position using a chatbot and are also developing a mobile application. There is reporting, a personal manager who answers all questions. This allows the investor to count on transparency and full operational management of the complex, the ability to monitor the condition, cash flow, optimization, and strategic management.

In cooperation with the management company, the investor only has to check the current financial status through the chosen communication format, use his free vacation days, and agree on possible repairs and depreciation, which are not taken without his approval, as it is his private property.

Investing in income-producing real estate, like other niches, requires basic knowledge of the market. Only by understanding the existing offer will you be able to choose the right property and management company. Pay attention to the reputation of the developer and hotel operator, ask the right questions, and don’t forget to analyze the project from the point of view of a tourist. Ask yourself an honest question whether you would choose this apart-hotel or cottage community for your vacation. Your attentiveness and thoughtful decisions will help you secure a profitable investment in hotel real estate.

More details at the link about investments in hotel real estate.

Subscribe to our blog so you don’t miss articles by Ribas Hotels Group experts!