Investing in apartment hotels in Bali: a guide for investors

Author: Ksenia Dronga, Head of the Ribas Hotels Group office in Bali

Bali is rapidly transforming from a tourist paradise to one of the most interesting sites for international hotel real estate investment. Apart-hotels are a key segment that combines stable income, flexible ownership and growing capitalization. This article summarizes the reasons why investors are increasingly choosing this format in Bali.

Reason No. 1: Stable demand

Bali is an Indonesian island that is consistently included in the list of the most popular vacation destinations in the world. Its tourist appeal is combined with Indonesia’s dynamic economic growth, which creates ideal conditions for real estate investment. In addition, the country’s government demonstrates loyalty to foreign investors by supporting capital investment in the Balinese hotel infrastructure.

In 2024, 6.3 million foreign tourists visited Bali. This is an impressive figure, indicating a stable and long-term interest in the island from an international audience.

Tourists are attracted not only by nature or beaches, but also by authentic culture, preserved traditions, and unique life experiences that include local rituals, gastronomy, surfing, mindfulness practices, and digital detox formats. Bali offers a balance between comfort and spiritual fulfillment – something that cannot be found in typical resort locations.

It is against the backdrop of this growing demand for experience and quality service that major international hotel operators such as Four Seasons Hotels and Resorts, Kempinski Hotels, Best Western Hotels & Resorts, and others are entering the country. They do not just build hotels, but create an offer that meets the expectations of a new generation of travelers. This also opens up a niche for private investors who can invest in units in new-format apart-hotels with a high level of service, concept and professional management.

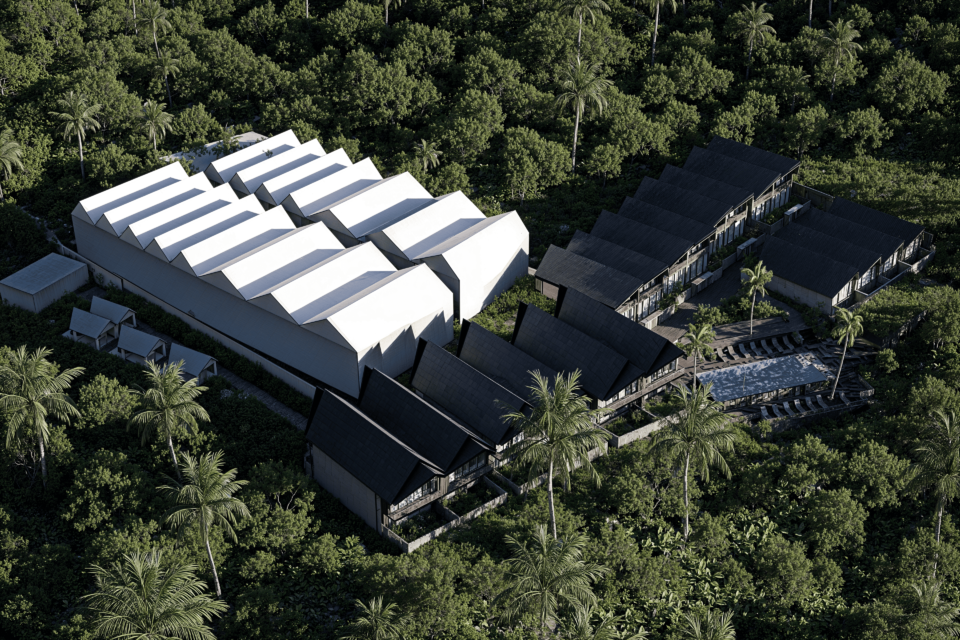

Visualization: PGD Aparthotel (Bali)

Reason No 2: A Transparent Passive Income Model

Aparthotels are among the most attractive investment options for those seeking to combine asset ownership with a stable passive income. In high-quality projects, investors receive not just an apartment, but a share in a functioning business model that includes service, management, and transparent financial reporting.

In well-structured projects, the actual ROI can reach up to 15% annually — provided the concept, location, and operational team are chosen wisely. The most reliable developers offer quarterly dividend payouts, a mobile app to monitor income, and financial models with forecasts for the year ahead. In many cases, a fixed return is guaranteed for the first few years to ensure a stable start.

Final profitability directly depends on how professionally the operational model is built: service, marketing, and guest satisfaction are key to ensuring consistent occupancy and revenue for investors.

According to a market study on income-generating real estate in Indonesia by Ribas Hotels Group, international tourists spend an average of 3.01 days on Bali — higher than the national Indonesian average of 2.85 days. The average number of guests per room is 1.82, which enables even small-scale properties to achieve high occupancy rates.

The average international tourist expenditure in Indonesia is $1,640 per person, with $320 spent on accommodation. This creates a predictable income model for aparthotels and allows for detailed financial forecasting — not just based on ROI, but also on average daily rates and occupancy levels.

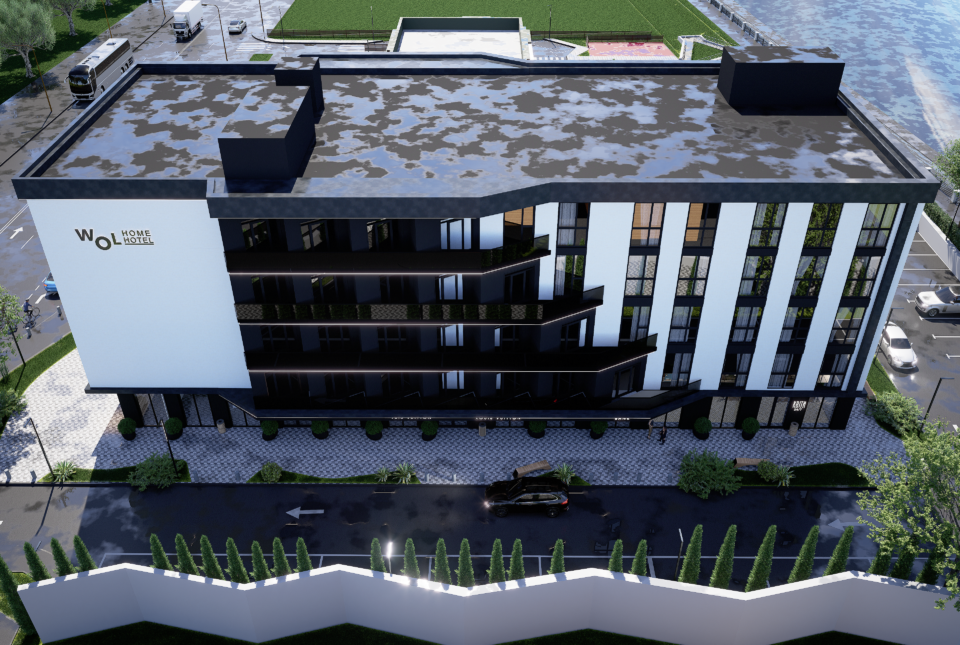

Visualization: PGD Aparthotel (Bali)

Reason No 3: From Square Meters to Branded Concepts Guests Are Willing to Pay More For

The demand for aparthotels in Bali has shifted: today’s guests are looking for more than just accommodation — they seek unique experiences. The core audience now includes couples, digital nomads, and mid-term travelers who crave the feeling of a “second home”: the functionality of an apartment, the comfort of a hotel, and the soul of a thoughtfully designed space.

Investing in concept-driven aparthotels opens access to a segment where:

- the average spend is higher;

- guests stay longer;

- guest loyalty is stronger;

- competition among “identical” projects is lower.

Wellness retreats, digital detox getaways, gastro hubs, and art communities have already proven their profitability in Europe and the U.S. — and are now rapidly gaining traction in Bali. Investing in a concept isn’t a risk; it’s a direct response to real market demand.

This is precisely the type of project being developed by Premier Global Development — a company specializing in aparthotels with strong concepts and full-service infrastructure, standing out from typical mass-market offerings. One of its flagship projects is PGD Aparthotel, located in the prestigious Tibubeneng area, near the popular tourist destination of Canggu. The complex will feature 85 units (71 one-bedroom and 14 two-bedroom apartments), covering a total area of 6,800 m². Construction is set to be completed in Q4 2025.

The projected capital appreciation for this development is up to 13.6% over 10 years.

PGD Aparthotel is designed for the modern traveler and digital nomad, offering amenities such as adult and children’s pools, a restaurant, coworking space, gym, open-air cinema, and parking for cars and motorbikes. This approach blends investment potential with tangible demand from the target audience.

Visualization: PGD Aparthotel (Bali)

Reason No 4: Land Prices Are Rising, Capitalization Is Growing — But Only for High-Quality Projects

One of the most significant economic factors currently driving the attractiveness of aparthotel investments in Bali is the rapid increase in land prices. Over the past two years, the cost of land in tourist-favored areas has doubled. At the same time, construction costs have also risen — primarily due to import restrictions and new tax regulations affecting both materials and logistics.

However, this trend creates an additional advantage for those investing in well-established, high-quality developments. Capitalization for such projects tends to grow most rapidly in the first 3–5 years — a window when demand is strong and supply is not yet oversaturated. Over time, growth potential may decrease due to the specifics of local land policies, particularly the limited land lease terms.

The regulatory environment is also evolving. New policies from local authorities are tightening control over the issuance of construction permits and related approvals. This means that only developers with transparent operations, proper legal support, financial stability, and experience in complex projects will remain on the market. The same applies to management companies — only professional operators with refined systems and strong reputations will thrive.

Despite some instability in the legal framework, the overall trend is upward. Global interest in Bali remains strong, and the aparthotel format continues to gain momentum. In this landscape, investors who choose reliable partners and accurately assess location and concept are positioned to benefit — both in terms of current returns and long-term capitalization.

Reason No 5: The Investor Isn’t Just an Apartment Owner — They’re a Hotel Business Partner

Unlike traditional property purchases (such as apartments or villas for rental income), investing in an aparthotel is essentially entering the hotel business through a shared ownership model. An investor doesn’t just acquire real estate — they become a co-owner of a functioning hospitality asset complete with an operational model, management, marketing, and guest services.

This provides several key benefits. First, the investor earns passive income without being involved in day-to-day operations: all aspects of bookings, maintenance, customer service, and technical support are handled by the management company.

Second, the owner typically has the opportunity to use their unit for personal stays — usually for several weeks or months per year — making this an especially appealing option for those who want to combine investment with travel.

Visualization: PGD Aparthotel (Bali)

How to Minimize Risks When Investing in Aparthotels in Bali

- Verify that all construction permits and legal approvals are in place.

- Ensure the land for the project is either fully paid for or has a legally transparent status.

- Review the developer’s track record and completed projects.

- Evaluate the management company: its portfolio, reputation, and hotel operations experience.

- Check the transparency of the financial model and the commitments outlined in contracts.

- Conduct an independent audit of the project (due diligence, approx. $500).

- Assess the reliability of the agency or intermediary, especially when handling a remote transaction.

Legal Considerations for Foreign Investors

- The dividend withholding tax in Indonesia is 20%.

- If there is no double taxation agreement between Indonesia and your home country, you may be taxed again in your jurisdiction.

- To avoid unexpected expenses, it’s crucial to get professional tax advice in your country beforehand.

Bali is not just a top travel destination — it’s a well-established and rapidly growing market for hospitality real estate, where demand consistently outpaces high-quality supply. Aparthotels are becoming a smart investment tool for those seeking not only income but access to a real business — with forecastable financial models, professional management, and long-term capital growth.

However, success only comes when decisions are based on thorough due diligence — not emotions. The key lies in carefully selecting the right developer, concept, and location. Bali offers real opportunities — but only well-informed investments turn those into results.

Getting ready to invest? Reach out — we’ll curate the best options tailored to your needs.

Download a free market research report on Indonesia’s income-generating real estate at the link.

Author: Ksenia Dronga, Head of the Ribas Hotels Group office in Bali