The West of Ukraine is the future of tourism: what symbiosis of real estate and investments is worthy of attention

Experts identify several sectors that are in demand even during crises or other powerful challenges. This includes the real estate sector, where two-thirds of all funds in the world are stored.

The proof of this is that for many decades investing in buildings and structures has been considered one of the most reliable ways to save money and capitalize it. So, what investment options in the real estate sector should be considered right now, as well as which object to choose in order to guarantee profitability, read the material on Channel 24.

Property types and market trends

Over the past 10 years, the real estate market has recorded a trend towards an increase in the cost of capitalization of all types of objects. However, only some of them can be competitive in modern conditions. As for the types of real estate objects, experts distinguish five main categories:

- Housing – the average profit is 7% – 8% per annum. At that time, it should be expected that it will pay off in 10 years, depending on the type, with a long-term lease;

- Office – profit is estimated at 9% per annum, rent per month is 2 – 5% of the value of real estate. This type of real estate will pay off in 8 – 10 years;

- With a commercial type of premises, you can count on a profit of 8 – 10% per annum, and the payback will take 5 – 7 years;

- Objects from the hotel sector can bring 10 – 15% per annum. While real estate pays off in 7 – 9 years, apart-hotels – in 6 – 8 years;

- Warehouse premises (100 – 500 square meters) will potentially bring the owner a profit of 9 – 11% per annum. This kind of object will pay off in 6 – 8 years, if the area is from 20,000 square meters, with a smaller area, this process will take up to 10 – 12 years.

Photo Source: Unsplash

Powerful Challenge

Of course, Russia’s war against Ukraine has become a powerful challenge to our country, financial markets, and the whole world. In particular, the full-scale invasion had a significant impact on investment in residential, office and retail properties./p>

For example, the portal of new buildings “LUN” reports that in 2022 the pace of construction fell by approximately 92%. The reasons are:

- unstable US dollar exchange rate;

- uncertainty about the security situation in the country.

The constant bombardment and shelling of the enemy has led to the fact that in Ukraine the demand for warehouse space has grown. The rent of this type of real estate in the capital of Ukraine – Kyiv – is estimated on average from 552.7 dollars to 700 dollars per square meter. The price is influenced by the quality and location of the warehouse. In addition, the price tag will grow until the market fixes sufficient volumes of supply.

Expert evaluation

Experts from one of the most powerful investment funds in Ukraine, Dragon Capital classify investments in smart apartments and hotel real estate as promising.

Demand for such objects has skyrocketed since the beginning of the great war. After all, thousands of Ukrainians were forced to leave their homes and seek safe shelter in other regions of the country. In this case, we are talking about medium and long-term stays.

Therefore, the market has a situation with huge demand and lack of supply. Dragon Capital added that there is a good chance that with the end of the active phase of the war, the real estate market will record a sharp rise in prices and an increase in investment in the construction of new projects.

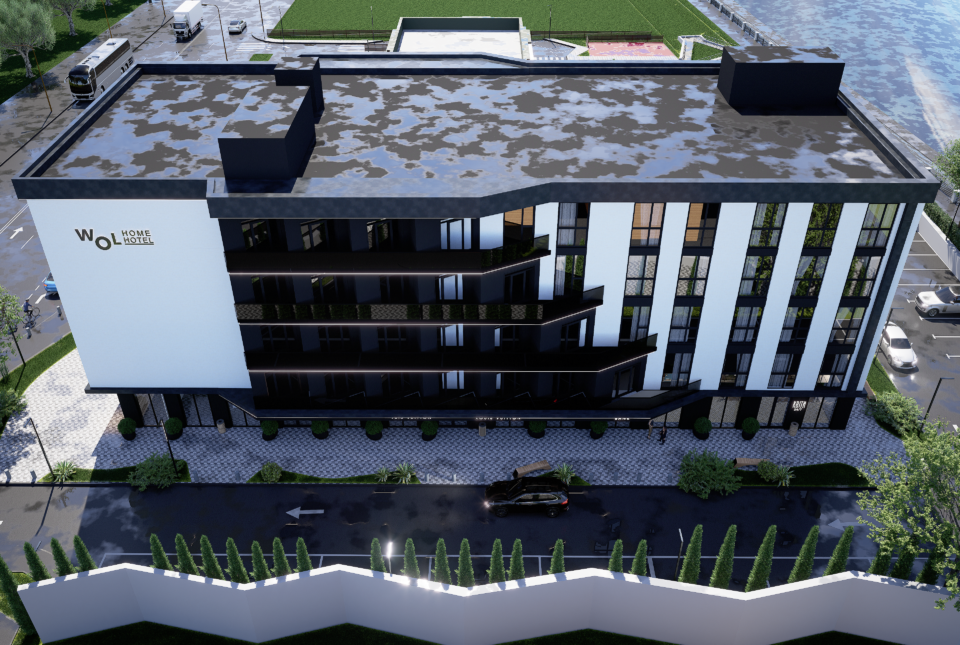

The tourism sector is going through a similar experience. In particular, in the next 5-10 years, the west of Ukraine will become the key center of domestic tourism. Many investors have already started transferring their money to hotel real estate in Ivano-Frankivsk, Lviv, Ternopil and other regions. Main reasons:

- large-scale mining of the Black and Azov seas;

- significant destruction in the resort towns under temporary occupation.

Photo Source: Unsplash

We remind you! The Ministry of Internal Affairs of Ukraine believes that it will take at least 5-7 years to completely clear the territory of our country from mines. As of the second half of June 2022, pyrotechnic units daily seized from 2,000 to 5,000 explosive items that the Russians left.

Analysis of the current market situation and prospects

According to a modern analysis of data on the real estate market, the cost per square meter in apart-hotels or cottage townships in development projects is growing. Just a few years ago, the total cost of a fully equipped hotel or apartment in Bukovel was 1000 – 1200 dollars per square meter. Currently, actual prices fluctuate in the range of 2500 – 5000 dollars per square meter.

Construction costs are also on the rise. Previously, you could build an object out of brick or concrete for $300 per square meter. However, today the cost has risen to 600 – 700 dollars per square meter. Let’s add even more numbers for one of the investment options:

- Having acquired at the initial stage of construction, for example, apartments for 100 thousand dollars, one can expect that this type of real estate will grow in price by 4-6% annually.

- This indicates that the passive income of the investor will be from 9 – 11% per annum.

- Over 7 years, the apartments will potentially rise in price to 150 thousand dollars, that is, the depositor will receive 70 thousand dollars.

- Thus, the price of the asset and passive income can be 220 thousand dollars from the initial investment of 100 thousand US dollars.

Photo Source: Unsplash

What you should know about risks

In general, investments are closely connected with risks. Experts distinguish several categories of assets according to the degree of risk. It is well known that cryptocurrencies are called one of the most risky instruments.

The real estate market is no exception in this context, but this sector is in demand even in times of complex challenges and crises. In modern conditions, there are also risks, most often associated with the management of real estate for the hotel business, explained Artur Lupashko, CEO and founder of the Ribas Hotels hotel chain. There are several highlights:

- It is very difficult to control all processes on your own, so you should pay attention to such an option as a reliable operator or a professional management company.

- It is especially important to study information about the history of their work, the objects with which they worked, customer reviews, payback rates (general norm – up to 10 years) and operating profitability (at least 40%).

Read the continuation on the website of the publication “Channel 24”

Subscribe to our blog to be aware of all the trends in the hospitality market!